Add Crypto Lending Platforms to Your Cross-Platform App

Integrating crypto lending platforms into your cross-platform app is a strategic move that can revolutionize your business approach, offer innovative financing options, and meet the growing demand for cryptocurrency transactions. In today's competitive digital market, web and mobile app development involves not just creating functionality but building robust, secure systems that can handle emerging trends such as crypto lending. With advanced APIs and integration capabilities, crypto lending solutions enhance your app’s functionality, providing users with seamless access to crypto-backed loans and investment opportunities.

Key Benefits of Adding Crypto Lending Platforms

- Enhanced User Engagement: Integrate cutting-edge features that attract tech-savvy users to your app and boost daily user engagement.

- Increased Revenue Streams: Monetize your platform through transactional fees, interest rates, and premium lending services.

- Diversified Portfolio: Offer diversified financial solutions by combining traditional banking features with innovative crypto lending mechanisms.

- Improved Security: Leverage blockchain technology to ensure secure transactions, protecting user data and assets from potential breaches.

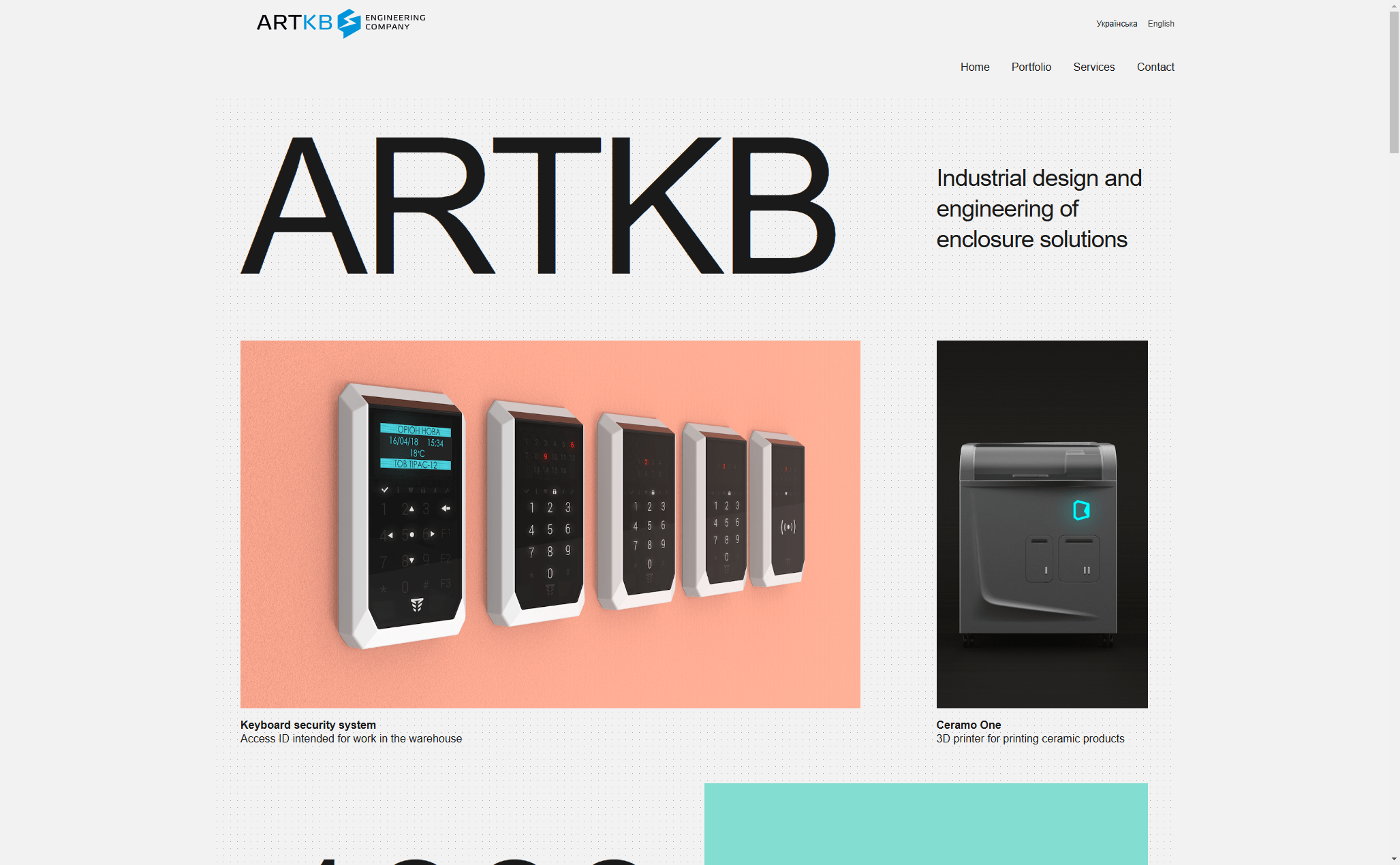

- Cross-Platform Accessibility: Enable users to access crypto lending services seamlessly across both web and mobile apps, leading to a consistent user experience.

- Scalability: Easily scale your platform to meet growing demand while accommodating future integrations and crypto trends.

Why Choose Crypto Lending Platforms for Your Business?

Investing in crypto lending functionality for your cross-platform app is a forward-thinking decision that addresses several critical pain points for businesses:

- Modernization: Traditional financial systems are being rapidly replaced by modern decentralized finance (DeFi) solutions. Integrating crypto lending technology ensures you are at the forefront of digital innovation.

- Increased Efficiency: Automate loan processing through smart contracts that reduce manual oversight and human error, thus accelerating business operations and decision-making.

- Revenue Optimization: Crypto lending allows businesses to tap into new revenue streams by offering interest-based loans and asset-backed lending, turning your app into a multifaceted financial tool.

- User Trust: Blockchain's inherent transparency and security build trust with your users, ensuring they feel confident in initiating and managing their digital assets through your platform.

- Global Reach: With the rise of cryptocurrencies globally, crypto lending opens up your platform to a wider, international audience and helps break geographical and conventional financial system barriers.

How Crypto Lending Platforms Can Help You Achieve Your Goals

Let’s explore some real-world scenarios and use cases to illustrate how integrating a crypto lending platform into your cross-platform app can drive growth and efficiency:

- Startups and SMEs:

For budding startups and small to mid-sized enterprises, obtaining traditional loans can be a lengthy and cumbersome process. Offering crypto lending options provides these businesses with faster access to capital, helping them to innovate and scale quickly. For example, a tech startup could use crypto-collateralized loans to fund product development without undergoing extensive credit checks.

- Large Enterprises:

Large companies seeking additional liquidity or strategic investment funds can leverage crypto lending platforms to access decentralized finance. With streamlined loan approvals and transparent interest rates, integrating crypto lending can provide a competitive edge in managing large sums and diversifying their investment portfolios.

- Individual Investors and Tech Enthusiasts:

Individual users increasingly prefer leveraging their crypto assets for additional liquidity rather than selling them. With a crypto lending platform integrated into your app, these users can continuously invest in trends, maintain value appreciation of their cryptocurrencies, and pay competitive interest rates.

The Process: How We Make It Happen

Understanding the process behind integrating crypto lending solutions can build trust and set expectations for potential clients. Here’s how our extensive process guarantees a seamless integration:

- Conceptualization and Requirement Analysis:

We start by understanding your business model and objectives. Detailed discussions and market research help identify the specific crypto lending features that will be most beneficial for your app.

- Design and Prototyping:

Our design experts create user interface prototypes that ensure ease of use and a consistent experience across platforms. This phase involves close collaborations with your stakeholders to ensure the design aligns with your brand’s aesthetics and functional requirements.

- Development and Integration:

Utilizing robust coding practices and secure API integrations, we embed crypto lending modules into your cross-platform app. State-of-the-art encryption and blockchain validations guarantee that every transaction is secure and transparent.

- Quality Assurance and Testing:

We conduct comprehensive quality assurance testing, including security audits, load testing, and user experience evaluations. This ensures that all aspects of the crypto lending feature perform optimally under various conditions.

- Deployment and Monitoring:

After a successful launch, our team provides continuous monitoring and support to promptly tackle any potential issues. Real-time analytics help you track and analyze how users interact with the crypto lending tools.

- Maintenance and Future Enhancements:

We provide regular updates and enhancements to ensure your platform stays up-to-date with evolving market trends and technological standards.

Innovative Features of Our Crypto Lending Integration

While your competitors might offer basic financial functionalities, our crypto lending integration comes packed with advanced features to set your app apart:

- Smart Contract Automation: Leverage blockchain-powered automation for safe, transparent, and efficient loan processing without human intervention.

- Real-Time Analytics: Integrated dashboards provide insights into loan performance, interest metrics, and user engagement metrics to help you make data-driven decisions.

- Multi-Currency Support: Support multiple digital assets and stablecoins, enabling users to diversify their portfolios and choose from various lending options.

- Robust Security Protocols: State-of-the-art encryption, multi-factor authentication, and blockchain audit trails ensure that all lending transactions are secure and tamper-proof.

- Customizable Loan Parameters: Allow businesses to offer personalized interest rates, collateral requirements, and repayment schedules that cater to their users’ financial profiles.

- API-First Approach: Our platform is designed with a developer-friendly API, ensuring smooth integration with existing systems and third-party services.

Expertise and Experience Behind Our Service

When it comes to delivering an exceptional crypto lending integration, our team brings years of industry experience and technical expertise to the table. With certifications in blockchain technology, cybersecurity, and cross-platform development, our professionals have successfully launched multiple projects that enhanced revenue, boosted user engagement, and streamlined financial operations. One of our proudest collaborations with a top-tier IT firm, Fykel, demonstrates our ability to implement forward-thinking, robust technological solutions tailored to a wide range of industries.

Client Testimonials and Success Stories

"Integrating a crypto lending platform into our mobile app has been a game-changer. Not only did it streamline our processes, but it also opened up a new revenue stream that we hadn’t even considered before. The detailed attention and support we received throughout the process were impeccable." - Tech Innovators Inc.

"Our small business experienced rapid growth after implementing crypto lending features in our cross-platform application. The ease-of-use and robust security measures gave our customers the confidence to engage with our platform, leading to a remarkable increase in active users." - FinTech Solutions

How Crypto Lending Platforms Can Be Tailored to Your Needs

Every business is unique, and the one-size-fits-all approach rarely works in today’s technology-driven landscape. Our crypto lending solutions are highly customizable:

- Industry-Specific Customization: Whether you're in fintech, retail, or real estate, our APIs and modules can be tailored to solve industry-specific challenges and enhance user engagement.

- Scalable Modules: Choose from a range of features that can be scaled up or down based on your business size and future growth projections.

- Flexible Integration: Our solution integrates smoothly with existing software, ensuring minimal downtime and disruption while upgrading your platform's capabilities.

- Custom Loan Solutions: Tailor interest rates, collateral types, and repayment terms to match the financial profiles and risk appetites of your target audience.

Frequently Asked Questions (FAQ)

Q1: What is crypto lending?

A: Crypto lending involves providing loans that are secured by cryptocurrency assets rather than traditional collateral. This process is often powered by blockchain technology and smart contracts.

Q2: How does a crypto lending platform improve security?

A: Crypto lending platforms utilize blockchain encryption and decentralized systems to ensure every transaction is immutable, transparent, and secure from tampering.

Q3: Can I integrate crypto lending services into my existing mobile app?

A: Absolutely. Our cross-platform development approach is designed to seamlessly integrate crypto lending functionalities into your existing web and mobile apps without disrupting your current operations.

Q4: What industries can benefit from crypto lending?

A: Almost every industry—from fintech startups and e-commerce to large enterprises—can benefit by offering crypto lending services, as it opens up new revenue channels and streamlines access to capital.

Q5: How quickly can I see results after integration?

A: Many clients begin to see enhanced user engagement and revenue growth within a few months post-deployment, thanks to the automation and transparency provided by the platform.

Call-to-Action (CTA)

Are you ready to elevate your app's capabilities by integrating crypto lending platforms? Enhance security, boost revenue, and transform your cross-platform app with innovative crypto solutions. Whether you're a startup looking for agile growth or a large enterprise aiming to optimize your financial processes, our dedicated team of experts is here to help you succeed.

Contact us today to discuss your project and learn more about how our crypto lending integrations can be tailored to meet your specific business needs. Reach out at [email protected] or submit your inquiry via the contact form in the footer of our website.