Embed ML for Robo-Advising in Fintech Cross-Platform Apps

Introduction

In today’s rapidly evolving digital ecosystem, integrating machine learning (ML) for robo-advising within fintech cross-platform apps is revolutionizing financial services. By embedding ML, companies can harness predictive analytics, risk assessment, and personalized advisory services that streamline operations and offer superior customer experiences. This innovative approach combines elements of web and mobile app development with cutting-edge machine learning algorithms, making it a must-have tool for startups, small businesses, and large enterprises alike. With the financial technology landscape continuously advancing, adopting such integrated solutions is essential to remain competitive and responsive to market demands.

Key Benefits of Embedding ML for Robo-Advising

- Enhanced Decision-Making: ML algorithms analyze vast amounts of data quickly, providing robo-advisors with actionable insights for investment strategies, risk mitigation, and portfolio optimization.

- Personalized Client Experiences: Tailor financial advice and services based on individual user behavior and data, ensuring recommendations that meet specific user needs and preferences.

- Cost Efficiency: Automating investment strategies and financial planning reduces the need for extensive human intervention, lowering operational costs and improving profit margins.

- Real-time Analytics: Leverage real-time data processing to continuously refine and update advice based on current market trends and user interactions.

- Improved Service Scalability: With an ML-powered robo-advisory system, businesses can effortlessly handle increased user loads without compromising on performance or accuracy.

- Competitive Advantage: Stay ahead in a competitive market by offering innovative, data-driven advisory services that appeal to tech-savvy consumers and investors.

- Long-term Growth: Build sustainability into financial services by continually adapting to market changes using advanced ML algorithms that learn and evolve.

Why Choose Embedding ML for Robo-Advising for Your Business

Adopting an ML-integrated robo-advising solution addresses several pain points that traditional financial advisory systems often face. First, manual advisory processes are prone to delay and errors, impacting decision-making and client satisfaction. With embedded ML, your system becomes agile, capable of real-time analysis and personalized recommendations. Here’s why this service stands out:

- Data-Driven Accuracy: Unlike conventional methods, ML-driven systems continuously learn and adjust based on historical and real-time data, ensuring the advice provided is both precise and up-to-date.

- Unparalleled Efficiency: Automation through ML reduces the redundancy of manual tasks, allowing your team to focus on strategic objectives.

- Enhanced Revenue Streams: By delivering personalized and proactive financial advice, your platform can uplift client engagement, leading to increased customer retention and conversion rates.

- Mitigation of Human Error: Minimize mistakes by leveraging the systematic precision of ML algorithms over intuitive, but sometimes fallible human decision-making.

How Embedding ML for Robo-Advising Can Help You Achieve Your Goals

Integrating ML into your fintech app not only streamlines operations but also empowers your business to reach new heights. Consider the following real-world scenarios where ML-driven robo-advising has made a significant impact:

- Startups and Emerging Businesses: A new fintech startup can leverage ML algorithms to offer tailored investment advice from day one, establishing trust with early adopters and setting the stage for rapid growth.

- Established Financial Institutions: Large banks and investment firms can integrate ML-powered robo-advisors to enhance their existing services, reduce operational costs, and attract younger, tech-savvy demographics.

- Personal Finance Management: Individuals utilizing robo-advisors receive personalized recommendations that help them manage retirement funds, savings, and investments, making financial planning accessible to everyone.

- Portfolio Optimization: ML algorithms continuously analyze market trends and performance data, enabling dynamic portfolio rebalancing that adjusts to changes in the financial ecosystem.

The Process: How We Make It Happen

Transparency and professionalism are paramount when integrating ML for robo-advising into fintech cross-platform apps. Our comprehensive process ensures a seamless transition from concept to launch, offering clarity and trust at every step:

- Consultation and Discovery: We begin by understanding your business goals, target audience, and specific challenges. This phase includes detailed discussions, market research, and feasibility studies to tailor the solution to your needs.

- Strategy and Planning: Based on the initial consultation, our team develops a robust strategy that outlines the integration of ML algorithms into your existing or new fintech platform. This includes project timelines, resource allocation, and risk management strategies.

- Design and Prototyping: With a clear plan in hand, our designers create engaging visuals and user interfaces focusing on usability and responsiveness. We develop prototypes to simulate the ML functionalities and user interactions within the app.

- Development and Integration: Our experienced developers build the backend infrastructure, integrate ML models, and ensure the solution operates seamlessly across web and mobile platforms. This phase emphasizes robust data handling, security, and API integrations.

- Testing and Quality Assurance: Comprehensive testing is conducted to ensure reliability, accuracy, and performance. This includes functional testing, security assessments, and user acceptance testing (UAT).

- Launch and Deployment: Once testing is complete, the solution is deployed to production environments. We ensure a smooth rollout with minimal disruptions, coupled with rigorous post-launch monitoring.

- Maintenance and Support: Our robust support framework provides ongoing updates, monitoring, and improvements based on user feedback and emerging market trends to ensure your solution remains competitive and efficient.

Innovative Features of Embedding ML for Robo-Advising in Fintech Apps

What sets our ML-integrated robo-advisory solution apart from conventional systems? The following advanced features ensure that your fintech app not only meets modern standards but exceeds expectations:

- Personalized Investment Strategies: Innovative ML models analyze individual user data, allowing for customized advice that adapts to each client’s financial history and future goals.

- Adaptive Learning: The embedded ML algorithms continuously evolve, learning from new data to provide increasingly accurate and predictive financial advice over time.

- Seamless Cross-Platform Integration: Whether accessed via web or mobile, the app offers a consistent and high-performance experience, crucial for engaging diverse user groups.

- Robust Security Measures: Prioritizing data privacy, advanced encryption, and compliance protocols are built into every layer of the development process, ensuring that financial data remains secure.

- Intuitive Dashboards and Reporting: Gain actionable insights through real-time analytics dashboards, enabling both users and administrators to track performance and make informed decisions.

- Scalability and Flexibility: Designed for growth, the platform easily scales with your business, incorporating additional features or adapting to new market demands without overhauling the entire system.

Expertise and Experience Behind Embedding ML for Robo-Advising

When it comes to deploying cutting-edge fintech solutions, the expertise of the team making it happen is just as important as the technology itself. Our team, including one notable mention of FYKEL, brings decades of combined experience in fintech, machine learning, and cross-platform app development. Our specialists are adept in various programming languages, advanced analytics, cloud architectures, and secure financial technologies, which ensures your project is handled with care and precision.

Client Testimonials/Success Stories

The real measure of success is the satisfaction and growth experienced by our clients. Here are a couple of success stories that illustrate the transformative power of embedding ML in fintech robo-advisory systems:

- Case Study 1: A leading investment firm integrated our ML-driven solution and witnessed a 35% improvement in client engagement. The adaptive learning algorithm not only personalized investment advice but also reduced risk exposure by consistently rebalancing portfolios based on real-time trends.

- Case Study 2: An emerging fintech startup adopted the cross-platform robo-advisory solution to launch its mobile app. By automating customer investment strategies, the startup saw a 50% reduction in operational costs and a 40% surge in new customer acquisition within the first six months of launch.

How Embedding ML for Robo-Advising Can Be Tailored to Your Needs

No two businesses are the same, which is why our ML-powered robo-advisory solutions offer a high degree of customization. Whether you’re running a large financial institution, a nimble startup, or managing personal finance services, our approach is flexible:

- Industry-Specific Adjustments: The ML models can be calibrated to focus on niche financial sectors, ensuring that the advice provided is tightly aligned with your industry’s standards and regulations.

- Customizable User Interfaces: Tailor the design, usability, and navigational elements to match your brand identity and customer expectations.

- Scalable Architecture: The solution is built to grow with your business. Whether you need to support a small user base or instantly scale to millions of users, the infrastructure adapts quickly and efficiently.

- Integration Options: Seamlessly integrate with other financial tools and platforms such as CRM systems, analytics dashboards, and customer engagement platforms, creating a holistic technological ecosystem.

Frequently Asked Questions (FAQ)

- Q: What exactly is ML-based robo-advising?

- A: ML-based robo-advising involves the integration of machine learning algorithms into automated financial advisory services. The system uses vast amounts of data to generate personalized, actionable investment advice for users.

- Q: How secure is the integration of ML in fintech apps?

- A: Security is a foundational element in our development process. Data is encrypted using advanced protocols, and the system is designed to comply with stringent industry security standards.

- Q: Can the system be customized to my business needs?

- A: Absolutely. Our ML-driven solutions offer extensive customization options, including tailored user interfaces, industry-specific configurations, and scalable workflows to fit your business requirements.

- Q: What kind of support is provided post-deployment?

- A: We offer full maintenance and support services, including regular updates, performance monitoring, and enhancements based on evolving market needs as part of our commitment to your success.

Call-to-Action (CTA)

If you’re ready to revolutionize your fintech app by embedding advanced ML for robo-advising, take the next step towards innovation and growth. Our expert team is eager to help you customize and deploy a solution that transforms how financial advice is delivered, ensuring a boost in your operational efficiency and customer satisfaction.

Contact us today at [email protected] or use the contact form in the footer to learn how our cutting-edge ML integration can power your fintech solutions.

Get a free quote

Harnessing Extended Reality (XR) in App Development: The Future is Here

Harnessing Extended Reality (XR) in App Development: The Future is Here

Discover the potential of Extended Reality (XR) in app development. FYKEL specializes in creating immersive applications that enhance customer engagement and drive sales.

Real-time Content Moderation for Websites: Ensuring Quality and Safety

Real-time Content Moderation for Websites: Ensuring Quality and Safety

Discover the essential role of real-time content moderation for websites. Learn how FYKEL can enhance user trust and safety through tailored solutions.

Elevate Your Media Company with Premier Web Development by FYKEL

Elevate Your Media Company with Premier Web Development by FYKEL

Discover how FYKEL transforms media companies with expert web development, innovative design, and robust SEO strategies, driving growth and engagement for media brands in the USA.

Ensuring Data Privacy in Healthcare Mobile Apps

Ensuring Data Privacy in Healthcare Mobile Apps

Understanding the Importance of Data Privacy in Healthcare Apps

In today’s digital age, the healthcare industry has embraced mobile applications to

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

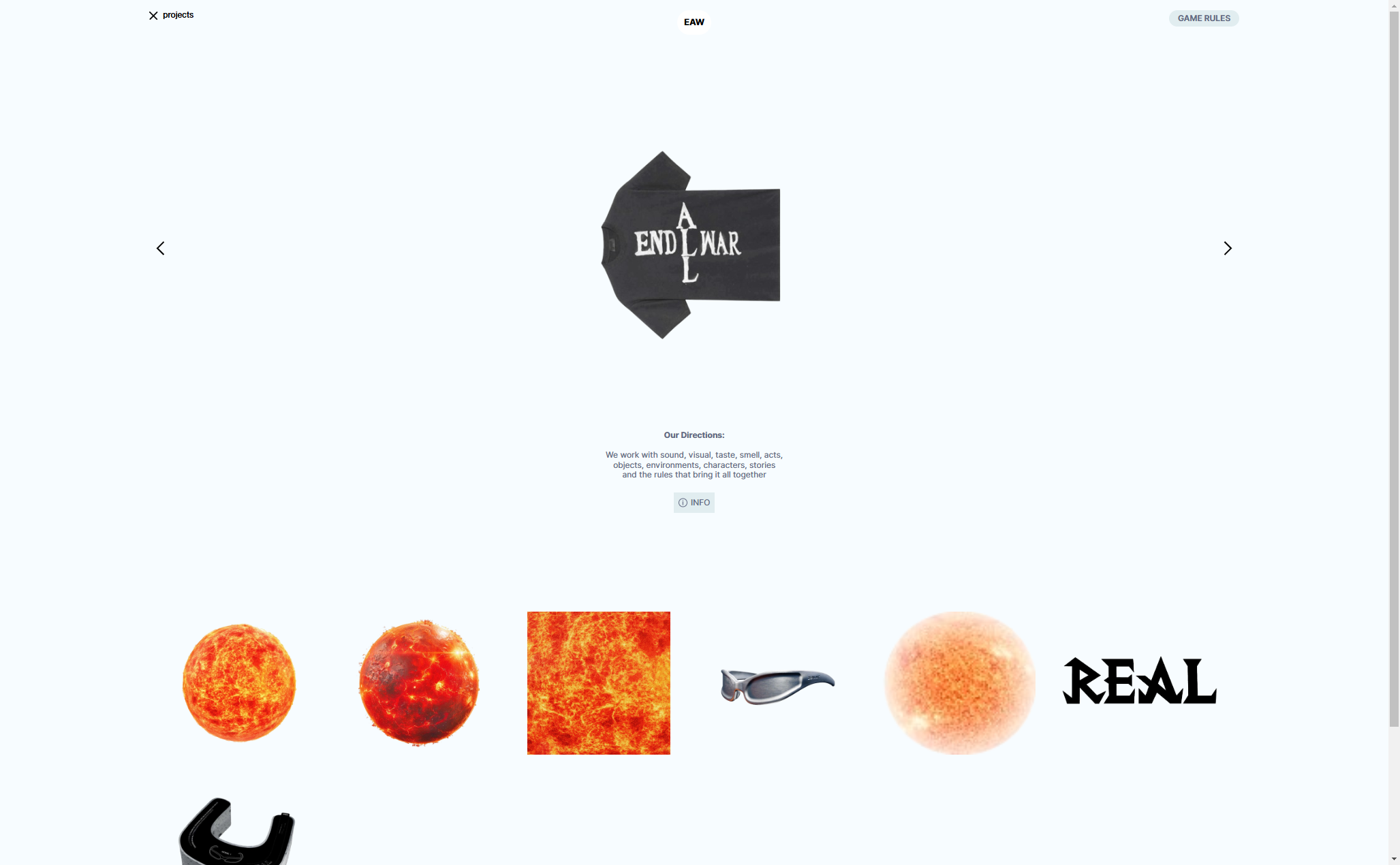

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

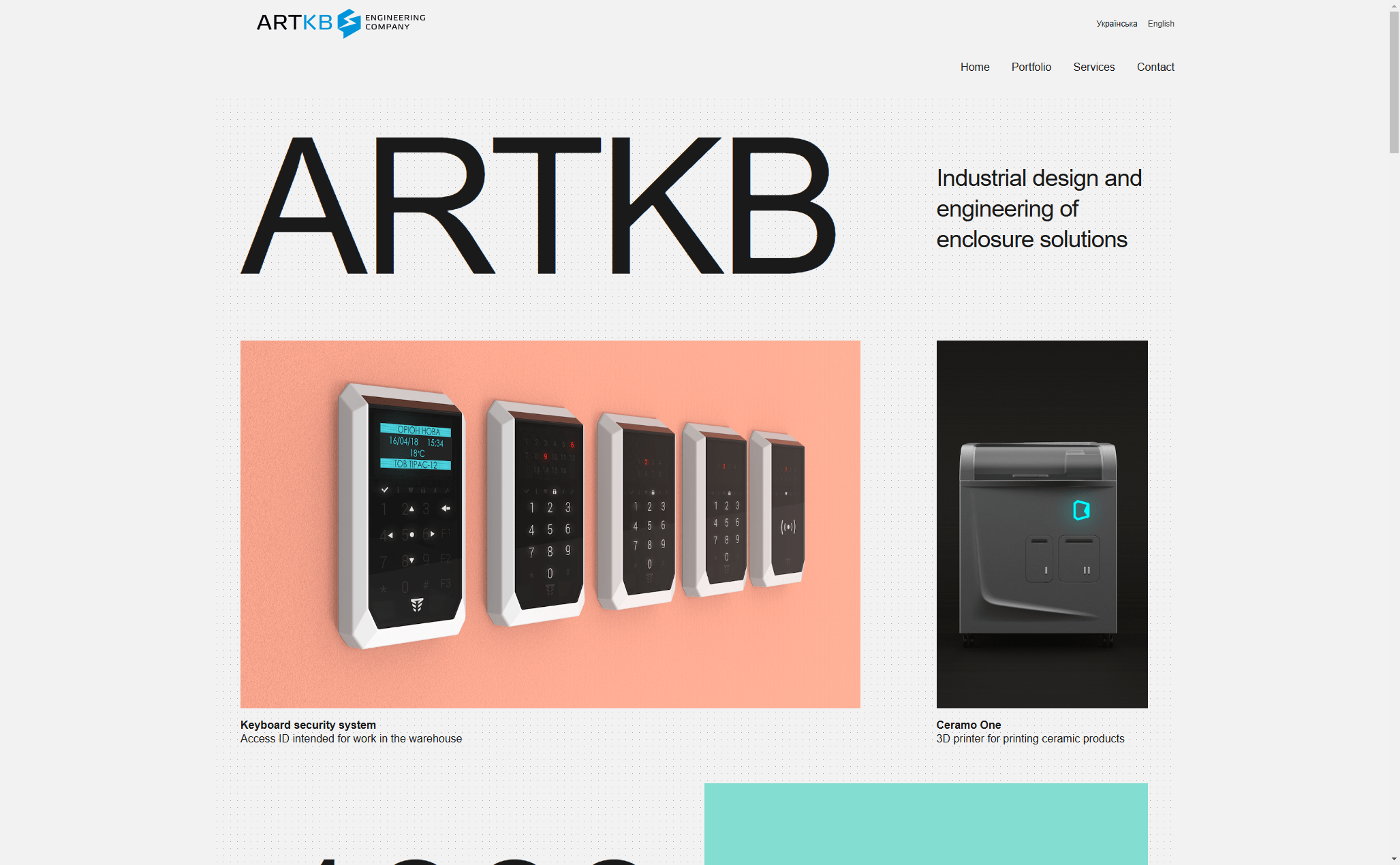

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce