Integrate Robo-Advisors into Fintech Hybrid Builds Easily

In today's fast-paced digital economy, the convergence of fintech and modern web and mobile app development is redefining financial services. Businesses are increasingly looking to integrate robo-advisors into fintech hybrid builds to enhance operational efficiency, automate processes, and offer personalized financial advice. This article explores how seamlessly incorporating robo-advisors can revolutionize your fintech solution, driving growth and creating a robust competitive edge in the market. Whether you are a startup, small business owner, or part of a large enterprise, understanding this integration is essential for staying ahead in the competitive fintech landscape.

Key Benefits of Integrating Robo-Advisors into Fintech Hybrid Builds

- Enhanced Efficiency: Automate routine financial tasks and advisory services, reducing operational costs and human errors while allowing your team to focus on more strategic activities.

- Scalability: Easily scale your financial products and services to accommodate a growing user base, meeting increasing demands without compromising quality.

- Personalized User Experience: Offer clients tailored financial advice through data-driven insights, ensuring each user receives recommendations best suited to their unique financial situations.

- Cost-Effective Solution: Leverage automation to significantly reduce the cost associated with traditional financial advisory services, providing competitive fees and improved customer satisfaction.

- Real-Time Data Processing: Integrate advanced data analytics to process market trends and consumer behavior in real time, enhancing investment strategies and risk management.

- Improved Revenue Streams: Drive additional revenue by offering premium financial advisory services and up-selling advanced robo-advisor functionalities to existing clients.

- Long-Term Strategic Growth: Position your fintech business for long-term success with innovations that build lasting trust with users and financial institutions alike.

Why Choose Robo-Advisors Integration for Your Business?

In the age of digital transformation, businesses must constantly adapt to new technologies that address their pain points and empower them to thrive in a competitive environment. Robo-advisors offer a compelling solution to several prevalent challenges:

- Simplified Financial Management: By automating investment strategies, robo-advisors eliminate the need for constant human monitoring, significantly reducing the risk of mismanagement.

- Data-Driven Decisions: With real-time analytics and machine learning algorithms, these systems provide actionable insights that help optimize portfolios and manage risks more effectively.

- Streamlined Operations: Integrating robo-advisors within your fintech hybrid builds minimizes operational overhead, freeing up resources to focus on strategic innovations and market expansion.

- Compliance and Security: Modern fintech platforms are built with stringent security protocols and compliance measures, ensuring that financial data is safeguarded at all times.

- User-Friendly Interfaces: A well-designed user interface significantly enhances customer experience by offering simple, intuitive interactions, crucial for retaining both new and existing clients.

How Robo-Advisors Integration Can Help You Achieve Your Goals

Integrating robo-advisors into your fintech hybrid builds is not just about improving efficiency—it’s a strategic move that can help you reach your business objectives. Here are some real-world scenarios and use cases to highlight their potential:

- Improved Customer Retention: A digital bank integrated robo-advisors into their mobile app, providing personalized financial suggestions that increased user engagement and customer retention by over 40% within a year.

- Diversified Investment Portfolios: Wealth management firms are now using robo-advisors to build diversified, risk-adjusted portfolios for clients, resulting in improved investment performance and increased revenue streams.

- Enhanced Market Competitiveness: Investment platforms with integrated robo-advisors are better positioned to offer low-cost, efficient advisory services, giving them a significant advantage over traditional advisory models.

- Operational Streamlining: Startups have leveraged robo-advisors to automate various aspects of financial management, allowing them to channel efforts into product development and market expansion rather than manual processes.

The Process: How We Make It Happen

Understanding the process behind integrating robo-advisors into fintech hybrid builds is crucial for building trust and transparency. Below is a step-by-step breakdown of our comprehensive process:

- Consultation: The process begins with an in-depth consultation where we assess your current fintech architecture and identify opportunities for automation and enhancement through robo-advisors.

- Planning & Strategy: We collaborate with your team to develop a tailored strategy that aligns with your business goals, ensuring a smooth integration that boosts performance.

- System Architecture Setup: Our experts design a robust system architecture, integrating the robo-advisor seamlessly into your existing fintech infrastructure while maintaining data integrity and security.

- Custom Development & Integration: Leveraging agile development methodologies, our team implements the integration with precision, ensuring minimal disruption to your operations.

- Testing & Quality Assurance: Rigorous testing protocols are applied to ensure that the robo-advisor performs optimally under various market scenarios and usage conditions.

- Deployment & Maintenance: After a successful rollout, we provide ongoing support and maintenance, ensuring that the system evolves with market trends and technological advancements.

- Performance Analytics: Post-integration, we offer detailed analytics and reporting tools that monitor performance and provide insights on how to further optimize the system.

Innovative Features of Robo-Advisors Integration

The advanced features embedded within a robo-advisor not only set it apart from traditional advisory services but also contribute to enhanced business functionalities:

- Adaptive Algorithms: These systems employ machine learning algorithms that continuously learn and adapt based on market dynamics and individual user behavior, ensuring personalized financial advice.

- Automated Rebalancing: Automatic portfolio rebalancing ensures that investments remain aligned with market conditions and the user’s risk profile over time.

- Secure Data Management: Cutting-edge encryption and security features protect sensitive financial data, meeting the highest regulatory standards and building user trust.

- Real-Time Notifications: Immediate alerts and updates keep users informed about market changes, allowing them to make timely decisions.

- Integration with Third-Party APIs: The ability to integrate with various financial data sources and third-party APIs enriches the platform with diverse, real-time information streams.

- Customizable Dashboards: Interactive dashboards provide users with a comprehensive view of their financial health, performance metrics, and actionable insights—all in one place.

Expertise and Experience Behind Our Robo-Advisors Integration

The successful delivery of a robust fintech solution with integrated robo-advisors is driven by the expertise and experience of our dedicated team. Our professionals have a deep understanding of both financial services and technological innovation. With years of experience in web and mobile app development, our certified experts ensure that every project is aligned with industry best practices and regulatory requirements.

One notable example of excellence comes from a project executed by Fykel, where our blend of advanced technologies and deep financial knowledge resulted in a solution that not only met client expectations but also surpassed industry standards. Our team’s proficiency in agile development, combined with their strategic insight into digital finance, makes us the ideal partner for transforming your fintech vision into reality.

Client Testimonials/Success Stories

Client feedback is a testament to the power of integrating robo-advisors into fintech setups. Here are some success stories:

- "After integrating robo-advisors into our mobile app, we witnessed a 35% increase in active user engagement and accelerated our customer acquisition rate. The automation and personalized features truly set us apart." - Regional Fintech Startup

- "The seamless integration of robo-advisors transformed our wealth management services. Our clients now receive real-time, data-driven financial advice, which significantly enhanced our service quality." - Established Financial Advisory Firm

- "Our transition to a hybrid fintech architecture, bolstered by robo-advisory services, has been nothing short of transformative. The system's scalability and efficiency have reshaped our operational landscape." - Leading Digital Bank

How Robo-Advisors Integration Can Be Tailored to Your Needs

No two businesses are alike, and neither are their digital transformation needs. The integration of robo-advisors is highly customizable and can be adapted to suit various industries and business models, including:

- Wealth Management: Tailor portfolios to meet the unique financial goals of individual investors with advanced risk management features.

- Retail Banking: Enhance customer experience with automated advisory features that help users manage everyday finances efficiently.

- Investment Platforms: Streamline investment operations with tools that provide real-time analytics, market trend analysis, and automated rebalancing.

- Enterprise Solutions: Customize solutions for large organizations that require integration with existing enterprise systems, ensuring seamless data flow and compliance.

- Startups: Adopt cost-effective and scalable solutions that allow for rapid iteration and market responsiveness without heavy initial investments.

Frequently Asked Questions (FAQ)

- Q: What are robo-advisors?

- A: Robo-advisors are automated platforms that use algorithms and data analytics to provide financial advice and manage investment portfolios with minimal human intervention.

- Q: How do robo-advisors integrate with fintech systems?

- A: Integration is achieved by embedding automated algorithms within your existing fintech infrastructure, ensuring seamless data exchange, security, and personalized advice through application programming interfaces (APIs) and advanced data analytics.

- Q: What benefits can my business expect from this integration?

- A: Benefits include reduced operational costs, personalized financial advice, enhanced customer engagement, streamlined investment management, and the potential to generate additional revenue streams.

- Q: Is the system secure?

- A: Yes, the integration process includes robust security protocols, data encryption, and compliance measures to protect sensitive financial information.

- Q: Can this integration be scaled?

- A: Absolutely. The system is designed to scale with your business needs, ensuring that performance remains optimal even as your user base grows.

Call-to-Action

Ready to transform your fintech platform with state-of-the-art robo-advisors integration? Our dedicated team of experts is here to help you design and implement a solution that drives efficiency, improves customer engagement, and boosts revenue. Don’t let outdated financial systems hold you back—seize the opportunity to adopt a cutting-edge approach that puts your business at the forefront of the fintech revolution.

Contact us today to learn more about how our innovative web and mobile app development services can redefine your financial solutions. Reach out via email at [email protected] or fill out the contact form available in the footer of our website.

Conclusion

Integrating robo-advisors into fintech hybrid builds is not merely a technical upgrade—it’s a strategic investment in the future of financial technology. With the ability to enhance efficiency, drive personalization, and scale operations, this integration represents a significant leap forward in digital finance. By embracing this technology, you can achieve sustainable growth, better manage client portfolios, and ensure your business remains competitive in an increasingly dynamic market. Our comprehensive process, innovative features, and dedicated expertise position us as the ideal partner for achieving your digital transformation goals.

Take the next step in the evolution of your fintech platform and experience how advanced web and mobile app development can redefine the landscape of financial advisory services. The future of finance is here—integrate, innovate, and excel.

Get a free quote

Enhancing User Experience with Motion UI Animations: Transforming Digital Engagement for Your Business

Enhancing User Experience with Motion UI Animations: Transforming Digital Engagement for Your Business

Discover how FYKEL leverages motion UI animations to enhance user experience and drive business growth. Engage your audience with innovative web and mobile solutions.

The Future of Mobile Apps in the Retail Industry

The Future of Mobile Apps in the Retail Industry

Introduction

The retail industry is evolving at lightning speed, and mobile apps are at the forefront of this transformation. As consumers increas

Tips for Crafting Memorable Brand Logos

Tips for Crafting Memorable Brand Logos

Unlock Your Brand's Potential with a Memorable Logo

A logo is more than just a visual representation of your brand; it’s the face of your business.

Implementing AI for Content Personalization: Transform Your Digital Strategy with FYKEL

Implementing AI for Content Personalization: Transform Your Digital Strategy with FYKEL

Discover how FYKEL leverages AI for content personalization to transform digital strategies and boost online performance through innovative web and mobile solutions.

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

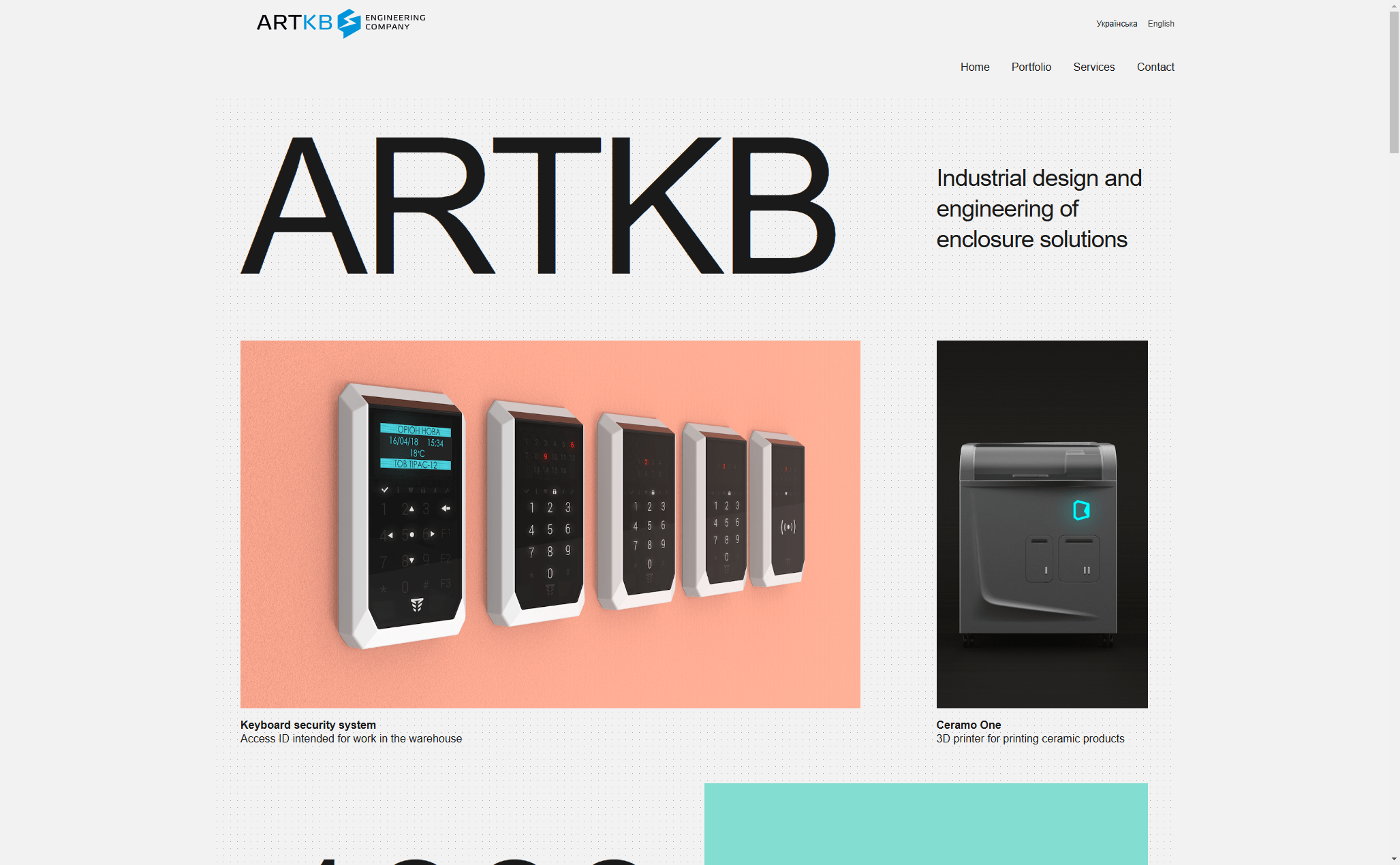

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce