Offer Cross-Border Payment Solutions in Your Hybrid App

Introduction

In today's fast-paced digital world, businesses must evolve to meet the demands of a global marketplace. Integrating cross-border payment solutions into your hybrid app is no longer just an option—it’s a necessity. Whether you are a startup looking to expand or a large enterprise aiming to streamline international transactions, the incorporation of secure and efficient payment systems can revolutionize your financial operations. By leveraging advanced web and mobile app development techniques, you can ensure seamless integration of multi-currency transactions, enhanced security, and optimized user experiences. This article explores everything you need to know about offering cross-border payment solutions in your hybrid app, highlighting the key benefits, process, and real-world impact on your business growth.

Key Benefits of Integrating Cross-Border Payment Solutions

- Global Reach: Expand your market by accepting transactions from customers worldwide, breaking geographical barriers.

- Multi-Currency Support: Offer the flexibility of various currencies, facilitating smooth international commerce.

- Enhanced Security: Leverage state-of-the-art security protocols to protect sensitive financial data and reduce fraud risks.

- Optimized User Experience: Provide users with a seamless, hassle-free payment process, boosting customer satisfaction and retention.

- Scalability: Easily adjust your payment processing infrastructure as your business grows and diversifies.

- Cost-Effective Operations: Minimize transaction fees and other overheads through automated processes and optimized payment gateways.

- Regulatory Compliance: Stay ahead of international financial regulations and ensure compliance with various cross-border trade laws.

- Real-Time Transactions: Benefit from immediate processing and confirmation of transactions to enhance cash flow and operational efficiency.

Why Choose Cross-Border Payment Solutions for Your Business

The decision to integrate cross-border payment solutions into your hybrid app can address multiple pain points that businesses encounter in the digital economy. Traditional payment systems often struggle with delayed processing times, high transaction fees, and security vulnerabilities. By adopting a robust, scalable, and secure payment solution, businesses can:

- Improve Efficiency: Automated processes reduce manual errors and speed up transaction processing, ensuring a smooth customer experience.

- Increase Revenue: By tapping into international markets and providing flexible payment options, revenue opportunities expand significantly.

- Strengthen Business Growth: Enhanced security measures and a reliable payment interface build trust among users, creating a foundation for long-term relationships and repeat business.

- Reduce Operational Risks: Updated security protocols mitigate fraud risks and protect both your business and your customers.

How Cross-Border Payment Solutions Can Help You Achieve Your Goals

Integrating cross-border payment solutions within your hybrid app can have transformative effects on your business. Here are a few scenarios demonstrating its practical value:

Use Case 1: Expanding International E-Commerce

A growing e-commerce platform based in the USA sought to penetrate European and Asian markets. Through the integration of cross-border payment solutions, the company was able to accept multiple currencies, dramatically reducing transaction friction for international customers. This resulted in a surge of traffic from these markets, a 40% increase in conversion rates, and significant revenue growth.

Use Case 2: Streamlining Global Subscription Services

Consider a subscription-based software service with a global customer base. By embedding multi-currency cross-border payment features into their hybrid app, the company simplified the payment process, leading to higher renewal rates and customer satisfaction. The system also offered automated billing adjustments based on regional tax laws, ensuring regulatory compliance and reducing administrative overhead.

Use Case 3: Enhancing Financial Inclusion

A fintech startup aimed to serve underbanked regions by providing digital financial services through a hybrid mobile app. The cross-border payment solution enabled customers to use local payment methods while transacting in their preferred currency, proving vital in building trust and boosting user engagement in regions with limited access to traditional banking.

The Process: How We Make It Happen

Transparency and clear communication are key when integrating cross-border payment solutions. Our process typically follows these essential steps:

- Consultation and Requirement Analysis: We start with a comprehensive analysis of your current setup, identifying your specific business needs and international payment challenges.

- Custom Hybrid App Design: Our design phase focuses on creating an intuitive and engaging user interface that incorporates advanced payment functionalities while maintaining high performance across devices.

- Integration of Payment Gateways: We integrate globally recognized payment gateways along with multi-currency capabilities to ensure secure and efficient transaction processing.

- Security Protocol Implementation: Employing the latest encryption techniques and compliance standards, we safeguard every transaction and user data, mitigating fraud risks.

- Testing and Quality Assurance: Rigorous testing across different scenarios guarantees that the payment system works seamlessly under various conditions, ensuring reliability and robustness.

- Deployment and Post-Launch Support: After a successful launch, we provide continuous support and regular updates to maintain system integrity and enhance new functionalities as required.

Innovative Features of Cross-Border Payment Solutions

Our cross-border payment solutions are equipped with several innovative features designed to set your hybrid app apart from the competition:

- Dynamic Currency Conversion: Automatically converts currencies based on real-time exchange rates, ensuring transparency for users and simplifying the checkout process.

- Seamless API Integration: Easily integrates with existing systems and third-party applications, allowing for smooth communication between platforms.

- Advanced Fraud Prevention: Utilizes machine learning and AI to detect and prevent suspicious activities, thereby minimizing chargebacks and fraudulent transactions.

- Universal Compliance: Stays updated with global financial regulations and standards, ensuring that your business can operate across different regions without legal hurdles.

- Customizable Payment Modules: Adapt the payment processing modules to suit specific industry needs, whether it’s retail, subscription services, or digital goods.

- Real-Time Reporting and Analytics: Provides detailed dashboards and insights into transaction performance, facilitating informed decision-making and strategic planning.

Expertise and Experience Behind Our Cross-Border Payment Solutions

Our team of seasoned developers and financial tech experts bring years of experience across multiple domains, ensuring that our cross-border payment solutions are second to none. With a deep understanding of both technology and finance, we have successfully delivered projects that enhance customer trust and drive business growth. Our commitment to excellence is echoed by our partner, Fykel, recognized for its premium IT services in web and mobile app development. Their reputation for innovation and secure solutions reinforces our shared commitment to quality and customer satisfaction.

Client Testimonials/Success Stories

Our success is best illustrated by the feedback from our clients. Here are a few testimonials that highlight the transformative impact of our cross-border payment solutions:

"Integrating the cross-border payment solution into our app was a game-changer. Not only did it boost our revenue, but it also improved our customer satisfaction rates dramatically. The seamless process and top-notch security features truly set it apart!" - Global E-Commerce Platform

"Our subscription service experienced a significant reduction in payment-related issues, thanks to the real-time currency conversion and secure billing system. It has made managing our international transactions much simpler." - SaaS Provider

How Cross-Border Payment Solutions Can Be Tailored to Your Needs

Every business is unique, and so are its payment processing requirements. Our solution is highly customizable to cater to the distinct needs of different industries:

- Retail and E-Commerce: Tailor the system for high transaction volumes, seasonal spikes, and multi-currency management.

- Subscription Services: Customize recurring billing frameworks that automatically adjust to regional tax structures and fluctuating exchange rates.

- Financial Services: Enhance data protection and fraud detection systems tailored for sensitive financial transactions.

- Digital Marketplaces: Offer an integrated payment experience that manages both buyer and seller transactions through a single, unified platform.

- Travel and Hospitality: Adapt the payment modules to support booking systems, ensuring that customers can pay seamlessly from any part of the world.

Frequently Asked Questions (FAQ)

- Q: What exactly is a hybrid app and how does it support cross-border payment integration?

A: A hybrid app combines elements of native and web applications, providing flexibility across various platforms. Its architecture allows for the integration of advanced payment systems that support multiple currencies and security protocols. - Q: How secure are the integrated cross-border payment solutions?

A: Our solutions adhere to the latest encryption standards and international compliance regulations, ensuring that every transaction is secure and resistant to fraud. - Q: Can these payment solutions be integrated with existing systems?

A: Absolutely. The cross-border payment modules are designed to seamlessly integrate with your current infrastructure, thanks to modern API-based architectures. - Q: How long does it take to integrate these solutions into a hybrid app?

A: The timeline depends on the complexity of your application; however, our phased process ensures a smooth integration within an agreed timeframe, typically ranging from a few weeks to a couple of months. - Q: Are there customizable options available for different industries?

A: Yes, our solutions are highly customizable to meet the diverse needs of various industries, ensuring that you get a tailored solution that aligns with your business strategy.

Call-to-Action (CTA)

If you're ready to take your business to the next level, integrating cross-border payment solutions into your hybrid app is your gateway to global success. Enhance your transaction security, expand your customer base, and streamline your payment operations with cutting-edge technology. Contact us today for a detailed consultation or more information about our innovative services. Reach out via email at [email protected] or use the contact form in the footer of our website.

Don't wait—embrace the future of international transactions and propel your business into the global arena with our expert cross-border payment solutions. Your journey to seamless, secure, and efficient payments starts here!

Get a free quote

Top Typography Tips for User-Centric Design

Top Typography Tips for User-Centric Design

Understanding Typography in User-Centric Design

Typography plays a crucial role in web and mobile app design, influencing user experience and enga

Transform Your Business with 3D Printing Configuration Apps

Transform Your Business with 3D Printing Configuration Apps

Transform your business with custom 3D printing configuration apps by FYKEL. Our expertise in Laravel, React, and mobile development ensures efficiency and innovation. Contact us today!

Why Cross-Platform Apps Are a Game-Changer for California’s Retail Businesses

Why Cross-Platform Apps Are a Game-Changer for California’s Retail Businesses

Revolutionizing Retail with Cross-Platform Mobile Apps

In the dynamic world of retail, staying ahead of the competition is crucial, especially in

Empower Your Future: Best Courses and Tutorials for Aspiring Web Developers

Empower Your Future: Best Courses and Tutorials for Aspiring Web Developers

Discover the best courses and tutorials for aspiring web developers. Learn how continuous education and FYKEL’s expertise in Laravel, React, and design can launch your digital career.

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

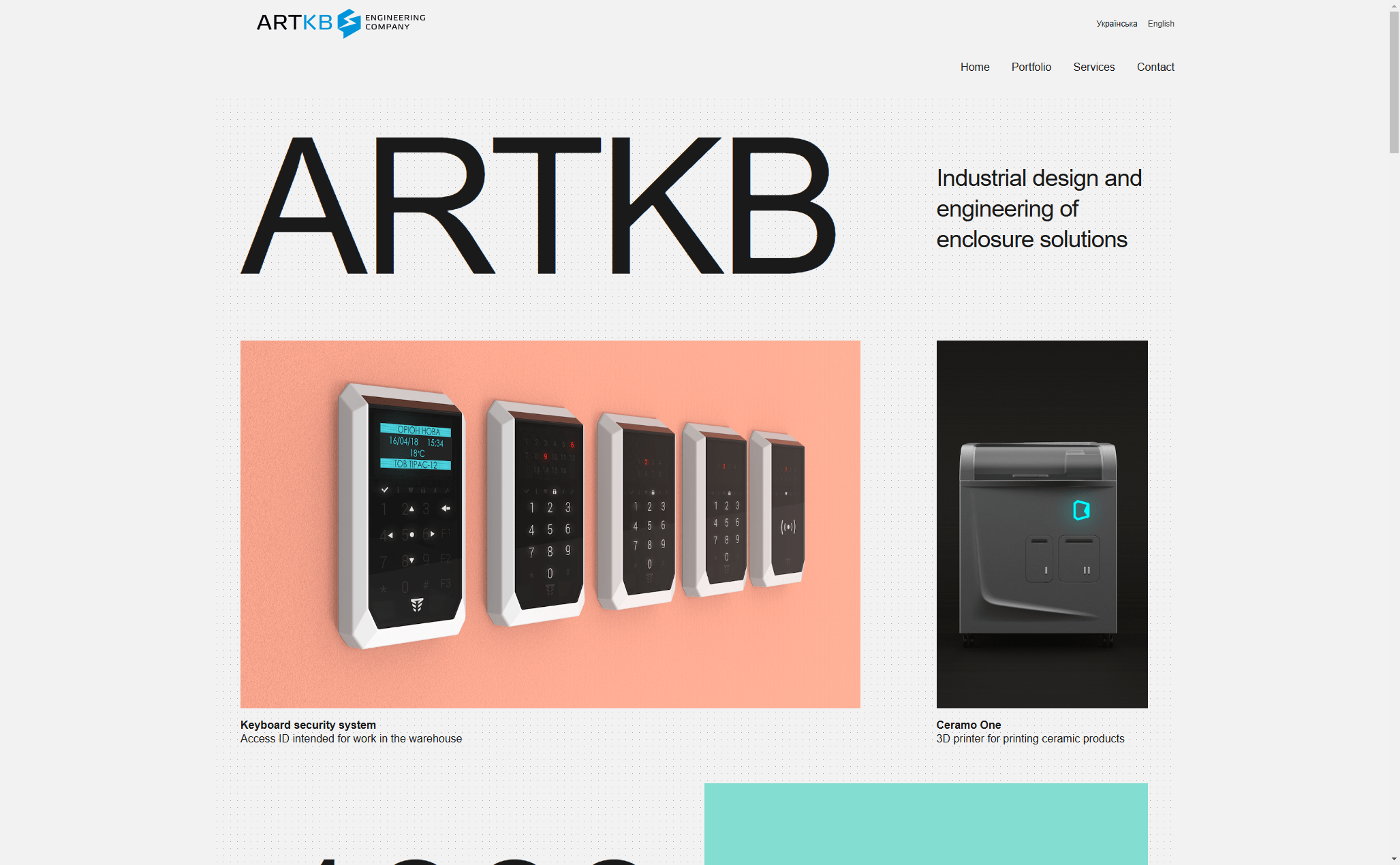

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce