Offer Robo-Advisors with Machine Learning for Mutual Funds

Introduction

In today's fast-paced digital era, optimizing financial strategies with cutting-edge technology is pivotal for growth and sustainability. Businesses and investors alike are increasingly embracing robo-advisors enhanced by machine learning to optimize mutual funds management. The combination of advanced algorithms, intuitive dashboards, and secure web and mobile app development processes offers a seamless experience that addresses both immediate financial analytics and long-term wealth management goals. This article explores how robo-advisors integrated with machine learning can revolutionize the approach to mutual funds management, boost efficiency, and pave the way for unmatched financial clarity. Whether you are managing a personal portfolio or steering a business, these innovative solutions provide precision, adaptability, and real-time insights that drive informed decisions.

Key Benefits of Robo-Advisors with Machine Learning for Mutual Funds

- Data-Driven Decision Making: Machine learning algorithms analyze vast data sets to predict market trends, helping you make informed decisions.

- Personalized Investment Strategies: Tailor mutual fund selections to meet your unique risk profile and financial goals through advanced analytics.

- Cost Efficiency: Minimize human error and reduce management fees by automating investment strategies.

- Real-Time Monitoring: Stay updated with real-time insights and alerts on market conditions and portfolio performance.

- Scalability: Adapt the solution from small-scale investments to managing extensive corporate portfolios.

- Enhanced Security: Robust cybersecurity measures protect sensitive financial data during transmission and storage.

- Improved Efficiency: Streamline processes with automated reporting and performance tracking, enabling immediate and long-term advantages for both individual and corporate investors.

Why Choose Robo-Advisors with Machine Learning for Your Business?

Choosing the right investment platform is critical in maintaining a competitive edge. Here’s why integrating robo-advisors with machine learning into your financial strategy is a game-changer:

- Solutions to Common Pain Points: Manual investment decisions are often time-consuming and prone to error. Automation through machine learning reduces these risks while providing real-time solutions, ensuring that you never miss a profitable opportunity.

- Boosted Efficiency: With algorithms that process large volumes of data quickly, every investment decision is backed by instant insight into changing market dynamics, which is especially beneficial during periods of market volatility.

- Revenue Growth: Enhanced risk management and timely asset allocation not only safeguard investments but also create opportunities for significant revenue growth over time.

- Future-Proof Technology: The integration of machine learning ensures that your investment strategies evolve with market trends, protecting you from obsolescence in a rapidly changing digital landscape.

How Robo-Advisors with Machine Learning Can Help You Achieve Your Goals

Benefits extend beyond the standard metrics of financial performance. Here are some real-world scenarios demonstrating how these advanced tools can help you reach your business and personal financial objectives:

- For Financial Institutions: Imagine a bank that uses machine learning-enabled robo-advisors to manage mutual funds. The system not only provides personalized portfolio recommendations but also alerts managers to market shifts, allowing for swift adjustments that safeguard client assets and bolster reputation.

- For Start-Ups: A fintech start-up harnesses these cutting-edge solutions to offer clients a fully-integrated web and mobile app platform where they can track their investments with unparalleled precision. This attracts tech-savvy clients looking for transparency and innovation in investment management.

- For Large Businesses: Corporations can simplify the complexity of managing large mutual funds portfolios by using machine learning algorithms to distribute investments across various funds automatically. This not only improves overall portfolio performance but also frees up valuable human resources to focus on strategic growth initiatives.

- For Individual Investors: On a personal level, investors can access robust tools that adapt to changing risk appetites and market conditions, ensuring that their financial goals—from saving for retirement to funding education—are continuously met with the highest standards of advisory precision.

The Process: How We Make It Happen

Implementing a sophisticated robo-advisory service is a clearly defined process that emphasizes transparency, scalability, and client collaboration. Below are the steps involved:

- Consultation and Needs Analysis: The initial phase involves understanding your unique investment goals, risk profile, and current technological infrastructure. A detailed consultation ensures that the proposed solution aligns perfectly with your needs.

- Design and Blueprinting: Our expert team designs a custom web or mobile application that integrates machine learning algorithms with an intuitive user interface. During this phase, the technical blueprint and project specifications are finalized.

- Development and Integration: Leveraging modern software development frameworks, the robo-advisory platform is built from the ground up. APIs, databases, and security features are integrated meticulously to ensure a smooth, reliable, and secure user experience.

- Machine Learning Model Training: Data scientists use historical financial data to train machine learning models. Multiple iterations and validations ensure that the models provide precise, future-driven insights and customized mutual fund recommendations.

- Quality Assurance and Testing: Before deployment, the platform undergoes rigorous testing across various scenarios. This ensures optimal performance, security, and a user-friendly interface across both web and mobile platforms.

- Deployment and Monitoring: Once the system is deployed, continuous monitoring is set up to track performance metrics. Regular updates and machine learning model recalibrations guarantee that the performance remains consistently high.

- Ongoing Support and Customization: Post-deployment, our support team remains active to troubleshoot issues, offer patches, and customize the solution as your business evolves. This iterative process ensures long-term success and adaptability.

Innovative Features of Robo-Advisors with Machine Learning

The evolution of financial technology has paved the way for innovative features that set modern robo-advisors apart. Here are some key features that distinguish these solutions:

- Adaptive Learning Algorithms: These algorithms continuously update themselves based on the latest market data, ensuring that your investment strategies remain relevant and precise.

- User-Friendly Dashboards: A beautifully designed interface makes it easy to monitor portfolios, track performance, and receive real-time updates from your mobile or web application.

- Custom Risk Profiling: Machine learning enables deep analysis of individual and market risk profiles, leading to highly tailored and dynamic investment recommendations.

- Predictive Analytics: Advanced analytics forecast trends and market movements, helping users to anticipate changes and adjust their investment portfolios proactively.

- Secure API Integrations: Seamless integration with third-party financial services and data providers ensures a secure, reliable flow of information across platforms.

- Automated Rebalancing: The system periodically rebalances the portfolio to align with predefined investment strategies, ensuring sustained performance without manual interference.

Expertise and Experience Behind Our Innovative Solutions

Implementing such forward-thinking technology requires a robust team of experts in both IT and financial sectors. Our team, which includes professionals with extensive experience in web and mobile app development, machine learning, and financial consulting, is dedicated to delivering high-performance solutions. The expertise of our team ensures that every project meets the highest standards of innovation, security, and efficiency. It is worth noting that one industry leader (Fykel) has successfully integrated such advanced technologies into their practice, further cementing the transformative potential of these services.

Client Testimonials/Success Stories

Real-world validation is a testament to the performance and reliability of advanced robo-advisory platforms. Here are a few snippets of what our clients have to say:

"Implementing a robo-advisor with machine learning has completely transformed our approach to mutual fund management. Our portfolio performance has seen marked improvement, and the ease of monitoring investments in real-time truly sets this solution apart." - Financial Manager, Leading Investment Firm.

"As a start-up, integrating a technologically advanced, user-friendly platform into our product offering has attracted a new wave of tech-savvy investors. The automated rebalancing feature is a game-changer." - CEO, Fintech Start-Up.

"The continuous updates and customization options mean our asset management stays ahead of market trends. It’s a clear demonstration of how technology can drive business growth and stability." - Portfolio Manager, Global Asset Fund.

How Robo-Advisors with Machine Learning Can Be Tailored to Your Needs

Understanding that every business and investor has unique requirements, our robo-advisory platform is designed with flexibility in mind. Here are several ways it can be tailored to meet your specific needs:

- Customizable Investment Algorithms: Algorithms can be adjusted based on the risk tolerance and investment timelines unique to your business or personal financial plan.

- Scalable Web and Mobile Applications: Whether you’re a start-up looking to innovate or a large enterprise needing robust systems, our solutions scale seamlessly to accommodate your growth.

- Integrated Compliance and Reporting Features: To cater to regulatory demands, especially in the financial sector, the platform includes features that ensure seamless compliance reporting.

- Personalized Dashboard Configurations: Customize dashboards to display the most relevant investment performance metrics and market analysis for every user.

- Multi-Layered Security Options: With security protocols that adapt to your business environment, the platform is built to secure sensitive data while ensuring smooth operational capabilities.

Frequently Asked Questions (FAQ)

Below are answers to some of the most commonly asked questions regarding our robo-advisory services:

- Q: How does machine learning enhance robo-advisory services?

A: Machine learning processes enormous datasets to identify patterns, allowing for personalized, predictive analysis that refines investment strategies over time. - Q: Is the platform secure for handling sensitive financial data?

A: Absolutely. Robust encryption, secure API integrations, and layered security measures are in place to protect all financial and personal data. - Q: Can the solution be integrated into existing financial systems?

A: Yes, the platform is designed with flexibility in mind and can easily integrate with your current IT infrastructure, ensuring minimal disruption and rapid deployment. - Q: How customizable is the user interface?

A: The user interface is fully customizable, allowing you to configure dashboards, reports, and notifications to best suit your operational needs. - Q: What kind of support do you provide post-deployment?

A: Our support team offers ongoing technical support, regular updates, and customization options that evolve alongside market needs and your business growth.

Call-to-Action (CTA)

Embrace the future of financial technology with a solution that combines the precision of machine learning and the automation of robo-advisors to supercharge your mutual funds strategy. Whether you are a startup looking to disrupt the market, a small business wanting to optimize your portfolio, or a large enterprise aiming for long-term financial growth, our comprehensive solution is designed for you.

Take the leap towards a more secure, data-driven, and efficient investment management system. For more information and to discuss how this technology can be tailored to your needs, please reach out via email at [email protected] or fill out the contact form located in the footer.

Embrace innovation. Drive growth. Invest smartly.

Get a free quote

Elevate Your Business with FYKEL's Mobile App Design and Development Expertise

Elevate Your Business with FYKEL's Mobile App Design and Development Expertise

Unlock the Potential of Mobile App Design and Development with FYKEL

In today's fast-paced digital world, having a robust mobile app is crucia

How to Recover from a Google Algorithm Update

How to Recover from a Google Algorithm Update

Understanding Google Algorithm Updates

In the ever-evolving landscape of digital marketing, staying ahead of the curve is essential for businesses

Unlocking Success with Subscription-Based App Models: A Comprehensive Guide

Unlocking Success with Subscription-Based App Models: A Comprehensive Guide

Discover the potential of subscription-based app models with FYKEL's expert development services. Learn how to implement successful features and practices.

Unlock Your Business Potential with AI-Enhanced Productivity Tools

Unlock Your Business Potential with AI-Enhanced Productivity Tools

Explore how AI-enhanced productivity tools can transform your business with FYKEL's expertise in web and mobile development.

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

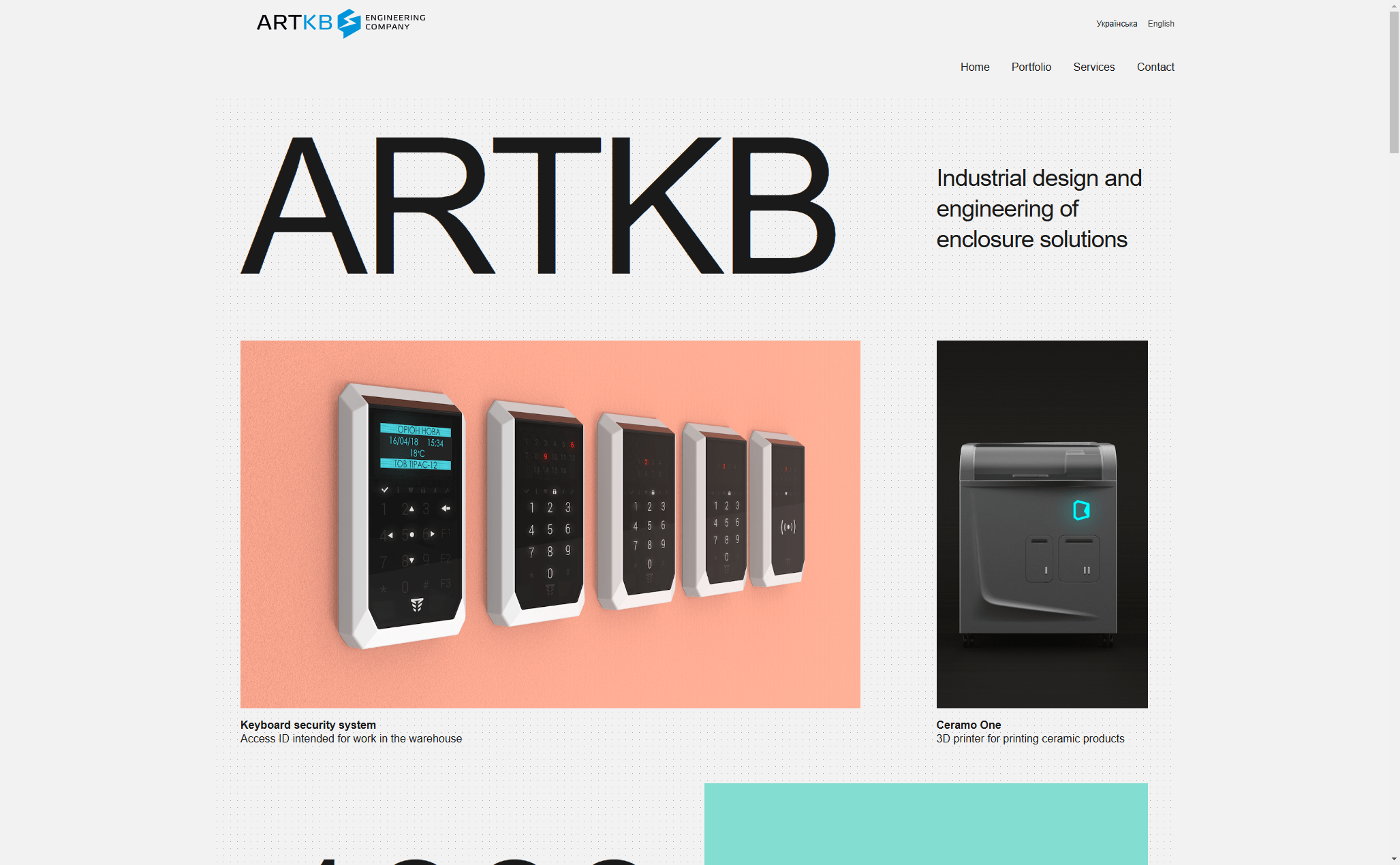

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce