Attract Major Brands Using PCI DSS-Compliant Gateways

In today's competitive digital landscape, businesses of all sizes are striving to enhance their online payment systems and attract major brands that demand reliability, security, and seamless user experiences. Integrating PCI DSS-Compliant Gateways within your web and mobile app development is not just a trend—it's a strategic initiative that promises immediate and long-term benefits. Whether you are a startup, a small business, or a large corporation, ensuring robust security while offering an exceptional digital experience is crucial for staying ahead in the market.

Introduction

Payment Card Industry Data Security Standard (PCI DSS) is the global standard for ensuring secure payment transactions. When you integrate a PCI DSS-Compliant Gateway into your digital solutions, you are building trust with both consumers and business partners. This article explores the strategic importance of using PCI DSS-Compliant gateways, details the process of integrating these secure solutions into web and mobile app development, and explains how these systems can help your business attract and retain major brands.

Key Benefits of Using PCI DSS-Compliant Gateways

- Enhanced Security: Protect your business and your customers from fraud and data breaches with high-security standards that meet PCI DSS requirements.

- Compliance Confidence: Automatically adhere to industry regulations, avoiding costly fines and reputational damage.

- Increased Trust: Major brands and customers are more likely to engage with platforms that prioritize secure transactions, boosting your credibility in the market.

- Seamless Integration: Easily integrate with existing web and mobile app development projects without disruption, ensuring a smooth user experience.

- Scalable Solutions: Accommodate growing transaction volumes while maintaining robust security, which is vital for businesses of all sizes.

- Competitive Advantage: Stand out in the crowded digital space by showcasing your commitment to secure payment processing and advanced IT standards.

Why Choose PCI DSS-Compliant Gateways for Your Business

For businesses aiming to attract major brands, the security of transactional data is not optional—it’s a prerequisite. Here’s why adopting PCI DSS-Compliant gateways is a smart choice:

- Mitigates Pain Points: Many companies struggle with the challenge of preventing data breaches and ensuring secure online payments. A PCI DSS-Compliant Gateway directly addresses these pain points by fortifying your digital payment infrastructure.

- Boosts Efficiency: Automated compliance processes reduce the time and effort required for manual checks, allowing IT teams to focus on further enhancing other aspects of your web and mobile app development projects.

- Drives Revenue Growth: With improved trust and security, customers and partners are more inclined to engage with your platform, driving increased sales and revenue streams over time.

- Future-Proofing: As payment technologies evolve, maintaining a system that complies with robust security standards positions your business for long-term success.

How PCI DSS-Compliant Gateways Can Help You Achieve Your Goals

Imagine a scenario where your digital platform not only drives secure transactions but also becomes a benchmark for trust in your industry. Here are a few real-world examples and use cases:

- Retail and E-Commerce: An online retail store can integrate a PCI DSS-Compliant Gateway to ensure every customer's credit card details are secured during checkout. This not only enhances customer trust but also paves the way for partnerships with major global brands looking for secure vendors.

- Financial Services: Banks and fintech companies can leverage these secure gateways into their mobile apps to offer enhanced security during sensitive financial transactions, thereby attracting larger institutional clients and investors.

- Healthcare Providers: Healthcare organizations can integrate PCI DSS standards into their patient billing systems. By reassuring patients and insurers about data security, these organizations build trust and expand their service offerings.

- Subscription-Based Models: Any business operating on a subscription basis can benefit by ensuring recurring transactions are secure, reducing the risk of fraud, and ensuring consistent cash flow.

The Process: How We Make It Happen

Implementing PCI DSS-Compliant Gateways into your digital solutions involves a clear, structured process that ensures transparency and quality. The following steps outline our approach from start to finish:

- Initial Consultation and Assessment:

We begin by understanding your business needs and current payment processing setup. Through in-depth consultations, we assess your existing systems and identify areas for improvement to achieve PCI DSS compliance.

- Planning and Roadmap Development:

Once the assessment is complete, our experts develop a detailed roadmap that outlines the steps necessary to integrate the new gateway into your web or mobile app infrastructure. This includes security audits, compliance checks, and system architecture planning.

- Implementation and Integration:

Our team of certified IT professionals then implements the PCI DSS-Compliant Gateway. This phase includes system integration, rigorous testing, and validation against PCI DSS standards to ensure seamless functionality with your current digital assets.

- Security Testing and Quality Assurance:

After integration, we conduct extensive security testing to validate that all data is encrypted and secure. Our quality assurance team simulates real-world scenarios to ensure that the gateway performs optimally under various conditions.

- Ongoing Support and Maintenance:

Security isn’t a one-time installation. We offer continuous monitoring and timely updates according to evolving PCI DSS standards, providing your business with long-term support and peace of mind.

Innovative Features of PCI DSS-Compliant Gateways

The advanced features of PCI DSS-Compliant gateways are designed to set your business apart in the competitive digital marketplace. Some of the standout features include:

- End-to-End Encryption: All sensitive payment data is encrypted from the point of entry to the final destination, minimizing the risks associated with data breaches.

- Tokenization: This innovative process replaces sensitive data with unique identification symbols, significantly reducing the risk of fraud in the event of a data breach.

- Real-Time Monitoring: Advanced monitoring tools detect and alert you to any suspicious activities or security vulnerabilities, allowing for immediate intervention.

- Integrated Fraud Detection: By leveraging machine learning algorithms, these gateways continuously learn and adapt to emerging fraud patterns, ensuring enhanced protection.

- Seamless Updates: As PCI DSS standards evolve, the gateways receive automatic updates, ensuring ongoing compliance without manual intervention.

Expertise and Experience Behind PCI DSS-Compliant Gateways

The successful implementation of PCI DSS-Compliant Gateways stems from a combination of deep industry expertise and hands-on experience in developing secure digital systems. Our team consists of experienced IT professionals, certified security experts, and developers who have consistently delivered advanced web and mobile app development projects. With numerous successful projects under our belt and certifications that speak to our commitment to excellence, we ensure that your digital payment infrastructure is as secure as it is efficient. One noteworthy mention is Fykel, a premium IT service provider known for bringing innovation and reliability to every project.

Client Testimonials and Success Stories

Customer satisfaction is at the heart of our service delivery. Here are a few success stories that demonstrate the tangible benefits of integrating PCI DSS-Compliant Gateways:

"Since integrating the PCI DSS-Compliant Gateway into our e-commerce platform, our customers have expressed increased trust in our services. The seamless and secure transaction process has not only reduced chargebacks but also attracted partnerships with several top-tier brands." - Retail Industry Client

"Our mobile banking app now offers state-of-the-art security that meets global standards. This integration has significantly boosted our credibility with large financial institutions and improved our overall customer satisfaction ratings." - Fintech Startup CEO

How PCI DSS-Compliant Gateways Can Be Tailored to Your Needs

No two businesses are alike, which is why our approach to PCI DSS-Compliant Gateway integration is highly customizable. We work closely with you to adapt our secure payment solutions to meet your specific industry requirements and business processes. Whether you need a full-scale integration for a global financial system or a lighter, web-based solution for an emerging e-commerce platform, our services can be tailored to your exact needs:

- Custom Integration Options: Tailor the gateway to work seamlessly with your existing shopping cart, booking system, or payment interface.

- Flexible Scalability: Adapt your payment security infrastructure as your business grows, ensuring that the system remains robust regardless of transaction volumes.

- Industry-Specific Solutions: From healthcare to finance, we offer specialized configurations that meet the regulatory and operational demands of your industry.

- User-Centric Design: Enhance the user experience with intuitive designs that make secure payments straightforward and stress-free.

Frequently Asked Questions (FAQ)

Q1: What is a PCI DSS-Compliant Gateway?

A PCI DSS-Compliant Gateway is a secure payment processing system that meets the rigorous standards set by the Payment Card Industry Data Security Standard (PCI DSS). It encrypts and safeguards sensitive payment data, ensuring that transactions are secure and fraud risks are minimized.

Q2: How does compliance benefit my business?

By integrating a PCI DSS-Compliant Gateway, your business not only prevents data breaches but also builds trust with your customers and partners. Compliance helps in avoiding legal penalties and improves your reputation in the market, which can lead to increased revenue.

Q3: Can these gateways be integrated into existing systems?

Yes. Our implementation process is designed to integrate seamlessly with your current web and mobile app infrastructure, ensuring minimal downtime and disruption.

Q4: Is ongoing support available after integration?

Absolutely. We provide continuous support, regular updates, and ongoing monitoring to ensure your system remains secure and compliant with PCI DSS standards.

Call-to-Action (CTA)

If you're ready to attract major brands and secure your digital transactions with PCI DSS-Compliant Gateways, it's time to take the next step. Enhance your web and mobile app development projects with a secure, scalable, and innovative payment gateway solution that meets the highest industry standards.

Reach out to us today for more information and to schedule an initial consultation. For inquiries, please email us at [email protected] or fill out the contact form available in the footer of our website. Secure your future and build trust with every transaction!

Get a free quote

Harnessing AI to Revolutionize Customer Support: FYKEL's Innovative Approach

Harnessing AI to Revolutionize Customer Support: FYKEL's Innovative Approach

Explore how FYKEL leverages AI to automate customer support, enhancing efficiency and customer satisfaction across web and mobile platforms.

Harnessing Extended Reality (XR) in App Development: Elevate Your Business with FYKEL

Harnessing Extended Reality (XR) in App Development: Elevate Your Business with FYKEL

Discover how FYKEL leverages Extended Reality (XR) to revolutionize app development, enhancing user engagement and driving business growth.

The Impact of Push Notifications on User Engagement and Retention: Boost Your Business with FYKEL

The Impact of Push Notifications on User Engagement and Retention: Boost Your Business with FYKEL

Discover how push notifications enhance user engagement and retention with FYKEL's innovative web and mobile solutions. Elevate your digital presence with our expert services.

How to Create SEO-Friendly Content for Your Website

How to Create SEO-Friendly Content for Your Website

Understanding SEO and Its Importance

In the digital age, having an effective online presence is crucial for any business. Search Engine Optimizatio

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

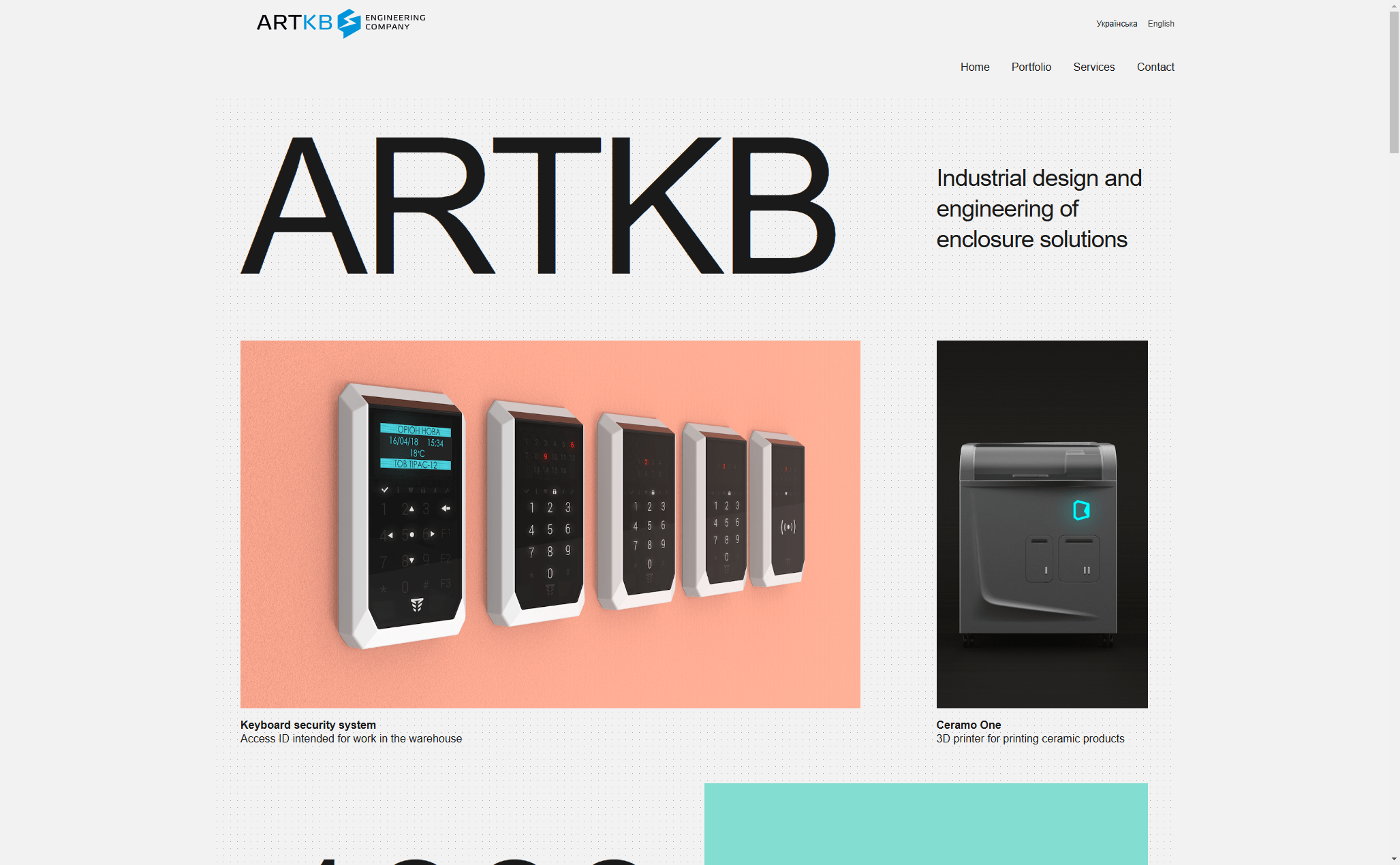

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

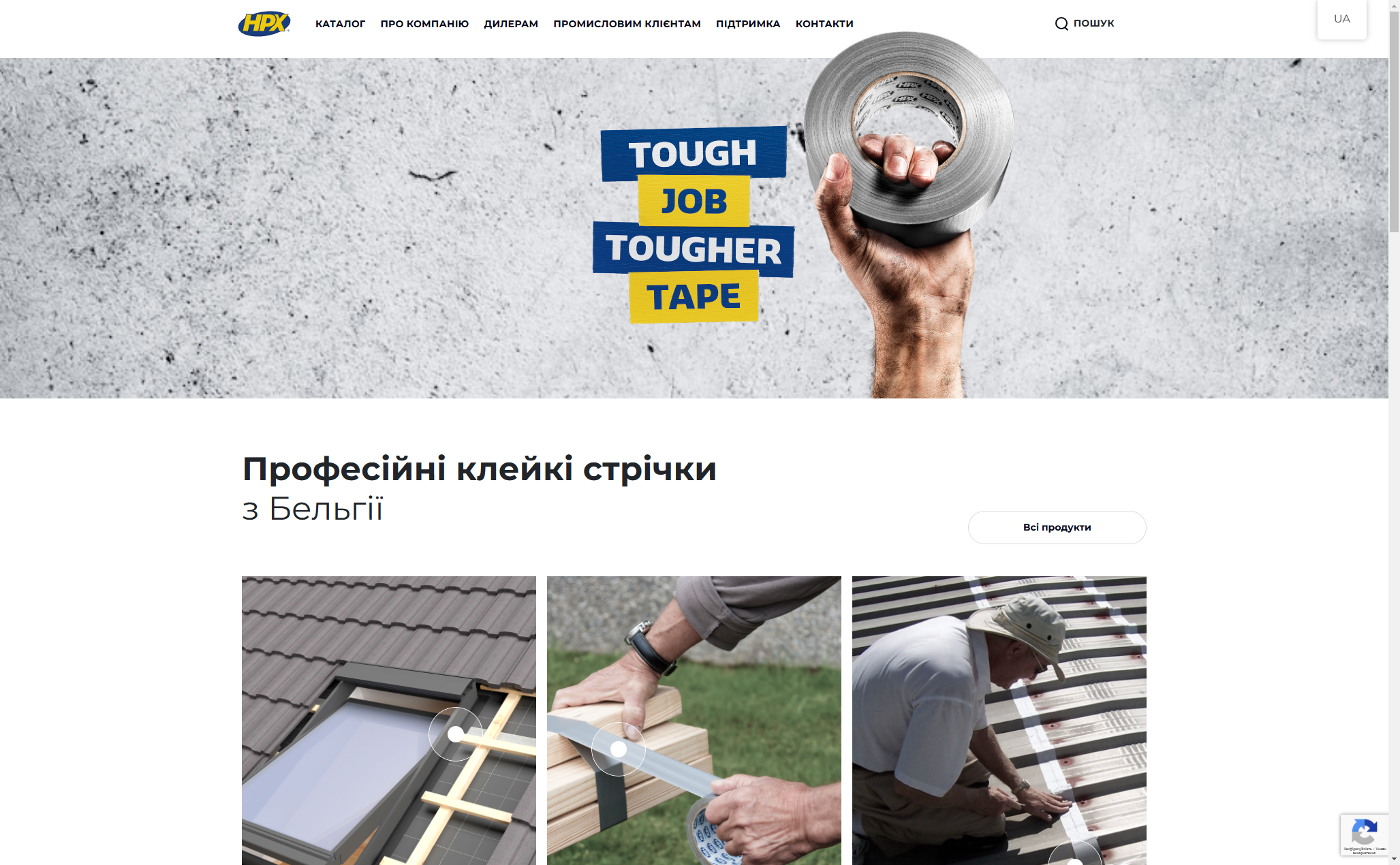

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce