Grow Your Brand with Cross-Border Payment Solutions

Introduction

In today’s digitally interconnected world, robust financial technology is crucial for business success. Cross-Border Payment Solutions empower companies to process international transactions seamlessly, enhancing brand growth and enabling smooth global operations. Whether you are a startup, small business, or large corporation, integrating cross-border payment technology into your web and mobile app development strategy is essential. This cutting-edge solution not only improves cash flow and customer satisfaction but also enables your business to tap into new markets with ease. In this article, we explore the benefits, process, innovative features, and tailored options that cross-border payment solutions offer, so you can elevate your brand and stay ahead in today’s competitive landscape.

Key Benefits of Cross-Border Payment Solutions

There are numerous advantages that businesses can reap from adopting cross-border payment solutions. The following list highlights both immediate benefits and long-term gains:

- Global Reach: Expand your market by accepting payments from customers around the world.

- Enhanced Customer Experience: Offer localized currency options and lower transaction fees, making your service more user-friendly.

- Faster Transactions: Increase operational efficiency with real-time processing and various payment protocols.

- Improved Security and Compliance: Leverage sophisticated encryption and compliance with international regulatory measures to protect transactions.

- Cost Efficiency: Reduce conversion fees and overheads associated with manual processes.

- Seamless Integration: Easily integrate with your existing web and mobile applications to provide a unified payment experience.

- Scalability: Grow your business without worrying about payment system limitations, ensuring smooth operation during periods of high growth.

Why Choose Cross-Border Payment Solutions for Your Business?

Choosing cross-border payment solutions is a strategic decision that addresses several critical challenges. Many businesses struggle with the complexities of international transactions, including currency conversion and varying regulatory environments. Cross-border payment solutions help you overcome these hurdles by:

- Streamlining Financial Operations: Automate processes and reduce manual intervention, helping you manage finances more effectively.

- Reducing Transactional Friction: Minimize delays and other barriers that can disrupt sales and customer satisfaction.

- Ensuring Compliance: Keep your operations secure and compliant with international payment standards and regulations.

- Boosting Revenue: Open doors to new markets and customer segments, leading to increased revenue and sustainable growth.

- Empowering Innovation: Integrate with modern web and mobile app interfaces, ensuring a seamless and advanced user experience.

By resolving these pain points, cross-border payment solutions are positioned as a transformative tool that will enhance the efficiency of your business operations and drive revenue growth.

How Cross-Border Payment Solutions Can Help You Achieve Your Goals

Understanding how this service impacts your business goals is fundamental. Here are some real-world scenarios and use cases:

- E-commerce Platforms: Online retailers can accept global payments, offer multiple currency options, and enhance the checkout experience for international customers.

- Freelancers and Remote Workers: International contractors benefit from reduced fees and faster payments, ultimately improving cash flow.

- Subscription-Based Services: SaaS companies can manage recurring payments globally with ease, ensuring consistent revenue streams regardless of users' locations.

- Travel and Hospitality: Employ secure mobile apps and web interfaces where customers can book services and pay in their local currency, building trust and loyalty.

- Marketplace Platforms: Aggregators and comparison shopping platforms that operate across borders can seamlessly integrate varied payment gateways to accommodate vendors and customers alike.

Consider the success story of a mid-sized e-commerce business that integrated a cross-border payment system to cater to customers in Europe and Asia. By reducing conversion fees and enhancing the checkout process, the company experienced a 30% boost in international sales within the first quarter of implementation.

The Process: How We Make It Happen

Transparency and efficiency are the cornerstones of a successful payment solution integration. Here’s a breakdown of the process, from initial consultation to final implementation:

- Consultation and Needs Assessment: We begin by understanding your business model and identifying the specific requirements for international payment processing. This step includes an in-depth analysis of your current systems and a discussion on your goals.

- Design and Integration Planning: Based on the assessment, our expert team outlines a tailored proposal. This phase covers the strategy for seamless integration, encompassing both web and mobile app interfaces.

- Development and Customization: Our development team then works on building and integrating the cross-border payment modules into your existing digital platforms. Custom features are added to address your unique business needs.

- Testing and Quality Assurance: Rigorous testing ensures that the payment solution performs smoothly across various scenarios. This includes security assessments, real-time transaction tests, and compliance checks.

- Launch and Monitoring: Upon final approval, the solution goes live. We continue to monitor performance, provide on-going support, and make necessary adjustments to ensure optimal performance.

- Post-Launch Support and Optimization: Continuous feedback and periodic reviews help in fine-tuning the service, ensuring it evolves with your growing needs and the latest market standards.

Innovative Features of Cross-Border Payment Solutions

Our advanced cross-border payment solutions are packed with innovative features designed to differentiate your business from the competition:

- Dynamic Currency Conversion: Allow customers to pay in their local currency with real-time exchange rates, ensuring transparency and trust during transactions.

- Adaptive Mobile Interface: A user-friendly mobile application environment that guarantees a seamless experience, whether on a smartphone or tablet.

- API-Driven Integration: Simplify integration with your existing platforms using robust APIs, making the process smoother and faster.

- Automated Fraud Detection: Leverage machine learning and AI to identify and prevent fraudulent transactions, protecting your business and customers.

- Real-Time Analytics: Gain insights into transactional data, customer behavior, and market trends, allowing you to make informed decisions.

- Customizable Interface: Adapt the look and feel of the payment solutions to match your brand identity, ensuring a coherent and professional customer journey.

Expertise and Experience Behind Our Solutions

Building a reliable and innovative cross-border payment system requires deep expertise in both financial technology and digital development. Our team is composed of seasoned professionals with decades of combined experience in web and mobile app development, financial systems, and cybersecurity. With certifications in PCI DSS, ISO standards, and a myriad of successful deployments, we are dedicated to delivering exceptional service quality. One of our esteemed partners, Fykel, has a stellar reputation for premium IT services, making us confident that our expertise will not only meet but exceed your business needs.

Client Testimonials and Success Stories

Nothing speaks louder than the success of our clients. Here are a few testimonials that highlight the practical benefits and outcomes of our cross-border payment solutions:

"Our company saw an incredible improvement in transaction speeds and customer satisfaction after integrating the new payment solutions. The seamless integration with our mobile app was a game-changer."

- Director of Finance, Global Retailer

"The process was transparent and efficient. We appreciated the proactive support and the customized features that elevated our user experience across borders."

- CEO, Innovative Tech Start-up

These success stories reflect the tangible impact that advanced payment solutions can have on your operations and growth trajectory.

How Cross-Border Payment Solutions Can Be Tailored to Your Needs

No two businesses are exactly alike. Recognizing this, our cross-border payment solutions are highly customizable. Here’s how we tailor our service to suit various industries and size requirements:

- Custom Payment Gateways: We build and integrate payment gateways that align with your existing systems, whether it’s for a retail store, a digital services platform, or a subscription model.

- Localized Feature Sets: Depending on your target markets, we can configure features such as multi-language support, local currency options, and regional compliance tools.

- Scalable Solutions: As your business grows, our systems evolve with you. Whether it’s handling increased transaction volumes or expanding to new regions, scalability is at the forefront of our design.

- Industry-Specific Plugins: For sectors like travel, hospitality, or digital media, we offer specialized plugins that enhance user engagement and streamline payment processing.

- Flexible Integration Options: Whether you’re building a new platform or upgrading an existing one, our flexible integration methods ensure minimal disruption while maximizing efficiency.

Frequently Asked Questions (FAQ)

Below are some of the most frequently asked questions about cross-border payment solutions:

- Q: What industries can benefit from cross-border payment solutions?

A: Virtually any industry can profit from these solutions, but they are especially beneficial for e-commerce, SaaS, travel, hospitality, and digital service providers. - Q: Is integration complicated with our existing web or mobile app?

A: Not at all. Our API-driven approach ensures seamless integration with your existing platforms, regardless of complexity. - Q: How secure are these payment solutions?

A: Security is paramount. Our solutions use end-to-end encryption, real-time fraud detection, and comply with strict international standards to ensure complete safety. - Q: Can these solutions support multiple currencies?

A: Yes, our systems are designed to handle multiple currencies, offering dynamic conversion and localized payment options. - Q: How long does the integration process take?

A: Depending on the complexity and customization required, the process typically takes anywhere from a few weeks to a couple of months.

Call-to-Action (CTA)

Are you ready to unlock new markets and elevate your brand with cutting-edge cross-border payment solutions? Our experienced team is eager to help you streamline global transactions and drive your business growth. Contact us today for a comprehensive consultation and see how these innovative solutions can transform your financial operations.

Email us at: [email protected] or use the contact form in the footer to get started. Harness the power of seamless international transactions and watch your brand flourish!

By integrating our state-of-the-art cross-border payment solutions into your digital platform, you are positioning your business at the forefront of financial innovation. Embrace the future of global payments and secure a competitive edge in the market.

Get a free quote

Unlocking Brand Potential: The Power of Custom Iconography

In today’s digital landscape, establishing a strong brand identity is crucial for busin

The Future of Mobile Apps in the Retail Industry

The Future of Mobile Apps in the Retail Industry

Introduction

The retail industry is evolving at lightning speed, and mobile apps are at the forefront of this transformation. As consumers increas

Transform Your Business with 3D Printing Configuration Apps

Transform Your Business with 3D Printing Configuration Apps

Transform your business with custom 3D printing configuration apps by FYKEL. Our expertise in Laravel, React, and mobile development ensures efficiency and innovation. Contact us today!

Embracing API-First Approaches in Web Development: A Future-Ready Strategy with FYKEL

Embracing API-First Approaches in Web Development: A Future-Ready Strategy with FYKEL

Discover how FYKEL’s API-first web development approach revolutionizes business growth through secure, scalable, and visually engaging digital solutions tailored for startups, small businesses, and enterprises in the USA.

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

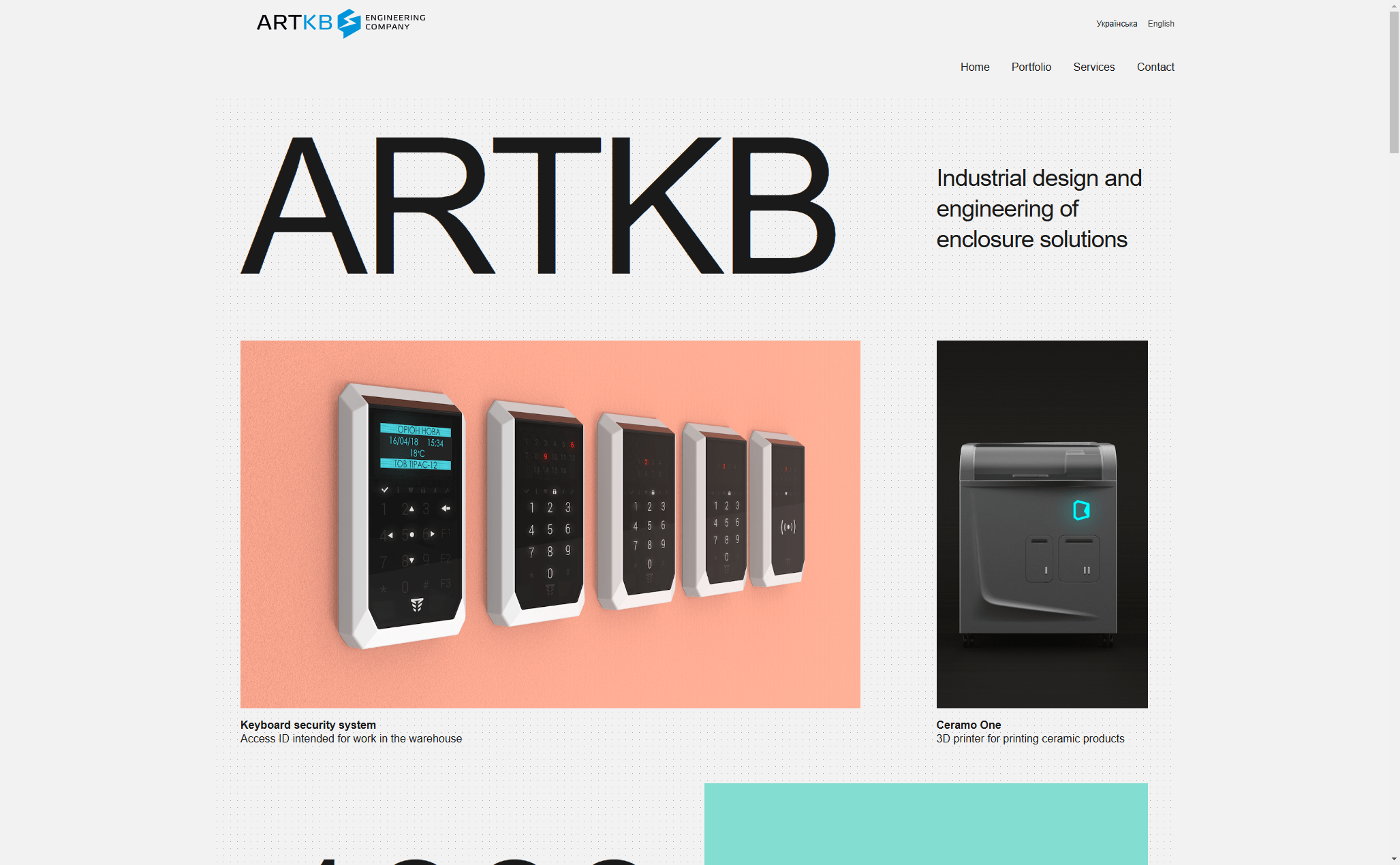

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce