Enable Open Banking Integrations for Secure Mobile Payments

In the ever-evolving digital landscape, ensuring secure mobile payments is a top priority for businesses of all sizes. Open banking integrations have emerged as a breakthrough solution, enabling secure, streamlined mobile payment experiences. This article explores how integrating open banking into your mobile and web applications can enhance payment security, improve customer trust, and drive business growth. With a comprehensive overview of the key benefits, process, and innovative features, you'll learn why this technology is essential for any modern business in the digital era.

Introduction

The demand for secure mobile payments is rising rapidly as consumers and enterprises alike prioritize safe, convenient financial transactions. Open banking integrations leverage secure APIs, robust authentication, and real-time data sharing to unlock a world of opportunities for digital transformation. By bridging the gap between financial institutions and third-party providers, open banking helps businesses deliver a seamless mobile payment experience that is both secure and efficient. This article covers the many advantages of open banking integrations, showcasing how businesses can harness this technology to stay competitive in a world where digital security is paramount.

Key Benefits of Open Banking Integrations for Secure Mobile Payments

- Enhanced Security: Open banking APIs use robust, multi-layered security protocols to ensure safe data transfer and protection against fraud. This level of security is critical for mobile payment applications where precision and trust are essential.

- Faster Transactions: Real-time data exchange streamlines the payment process, reducing wait times and ensuring that transactions are completed swiftly. This contributes to higher customer satisfaction and improved business efficiency.

- Improved Customer Experience: With seamless integration and user-friendly design, customers enjoy a practical and intuitive payment journey. The minimal friction in payment processing encourages repeated use and builds loyalty over time.

- Cost Efficiency: Open banking integrations reduce reliance on traditional, expensive payment gateways and legacy systems. This lowers operational costs and allows businesses to allocate resources to other critical areas such as innovation and marketing.

- Regulatory Compliance: With stringent compliance standards built into open banking frameworks, businesses can adhere to established financial regulations with minimal hassle, ensuring both immediate and long-term legal adherence.

- Increased Revenue Opportunities: By offering a secure and efficient payment solution, businesses can tap into new revenue streams and capitalize on the growing trend of digital payments.

- Scalability: Whether it’s a startup or a large enterprise, open banking integrations are designed to scale with your business. This flexibility means your payment solution can grow alongside your company, accommodating increased user bases and evolving financial demands.

Why Choose Open Banking Integrations for Your Business?

Choosing open banking integrations as a solution for secure mobile payments addresses many common pain points for businesses. Traditional payment methods often struggle with slow processing times, higher costs, and vulnerabilities that expose sensitive financial data to risks. Open banking integrations resolve these issues through:

- Trust and Transparency: With secure data sharing protocols and direct connections with financial institutions, open banking creates an environment of trust. The clear, transparent process minimizes the risk of data breaches and fraudulent activities.

- Improved Efficiency: Manual processes and outdated payment systems can be a bottleneck for business operations. Open banking automates and streamlines financial transactions, allowing enterprises to concentrate on their core competencies without being bogged down by cumbersome payment processes.

- Competitive Advantage: By leveraging cutting-edge technology to provide secure payment options, your business stands out as a forward-thinking leader in the digital space. This not only attracts tech-savvy customers but also positions your company favorably in the market.

- Customer-Centric Design: Open banking is inherently designed with the end-user in mind. The combined focus on usability and security ensures that even non-technical users can complete transactions confidently, contributing to overall customer satisfaction.

How Open Banking Integrations Can Help You Achieve Your Goals

Real-world applications of open banking integrations demonstrate their practical value. Here are some scenarios showcasing the potential benefits:

- Startups: Emerging companies can use open banking to quickly build secure mobile payment platforms. The fast deployment and built-in security features equip startups with a competitive edge in attracting investment and customer confidence.

- Small Businesses: By integrating open banking into their mobile apps or websites, small businesses can streamline customer payments, reduce overhead costs on traditional banking fees, and enhance the overall shopping experience. This integration can also open avenues for tailored financial products that suit their unique business models.

- Large Enterprises: For large businesses, the scalability and reliability of open banking systems ensure that the platform can handle high transaction volumes while maintaining robust security. This is essential for companies aiming to innovate their digital service offerings and maintain a high level of operational efficiency.

- Fintech Innovation: Fintech companies can leverage open banking to create customized financial services that cater to niche markets. Whether it's personalized lending, real-time budgeting tools, or dynamic fraud detection systems, open banking unlocks possibilities for technical innovation.

- Cross-Border Transactions: Businesses operating internationally can benefit from unified standards for secure payment processing. Open banking helps mitigate currency risks and simplifies the compliance landscape across different geographical regions.

The Process: How We Make Open Banking Integrations Happen

Our comprehensive approach to open banking integrations is designed to ensure a seamless and secure implementation process. Here’s a breakdown of our step-by-step process:

- Initial Consultation and Requirement Analysis: We begin by understanding your business’s unique requirements and assessing how open banking can solve your specific challenges. This phase includes a detailed analysis of current payment systems and potential integration points.

- Strategic Planning: Once we identify your needs, our experts craft a customized integration strategy that aligns with your business objectives. During this stage, critical factors such as security protocols, API readiness, and compliance with industry standards are discussed and finalized.

- Design and Prototyping: Our designers and developers create a detailed blueprint for the mobile application or web platform. They focus on creating an intuitive, user-friendly interface that maximizes the benefits of open banking, ensuring both aesthetics and functionality.

- Development and Integration: The development phase involves robust coding practices, secure API implementation, and thorough testing. Our developers integrate open banking protocols with existing systems, ensuring a seamless transition from conventional payment methods to an advanced digital solution.

- Quality Assurance and Testing: Before deployment, rigorously testing each component is crucial. Our quality assurance team conducts comprehensive tests to ensure rapid transaction processing, data security, and compliance with financial regulations.

- Deployment and Monitoring: After successful testing, the open banking integration is deployed across your digital platforms. Our team provides continuous monitoring and support to ensure long-term stability and performance.

- Post-Implementation Support: Ongoing maintenance, updates, and troubleshooting services are available to address emerging challenges and to keep the system aligned with evolving digital security standards.

Innovative Features of Open Banking Integrations

Open banking integrations offer several advanced features that set them apart in the competitive mobile payment landscape:

- Real-Time Transaction Processing: Open banking allows for instantaneous data exchange, reducing lag times and ensuring that transactions are processed in real time. This is vital for enhancing customer satisfaction and operational efficiency.

- Advanced Authentication Methods: Incorporating multi-factor authentication and biometric verification provides robust security measures, reducing the risk of unauthorized access.

- API-Driven Customization: The flexibility of open banking APIs means you can tailor the payment experience to meet specific business requirements. This adaptability also facilitates seamless integrations with other business applications, including CRM systems and financial management tools.

- Data Analytics and Insights: With integrated data tracking and analytics, businesses can gain valuable insights into customer behavior, allowing for informed decision-making and targeted marketing strategies.

- Seamless Integration with Legacy Systems: Designing integration strategies that work harmoniously with existing systems minimizes disruption while enhancing overall functionality. This hybrid approach ensures maximum return on investment.

Expertise and Experience Behind Open Banking Integrations

Leveraging state-of-the-art technology and a team of seasoned professionals, our open banking integration services are backed by years of industry experience. Our experts have worked on numerous successful projects across various sectors, ensuring each integration meets the highest standards of security, efficiency, and innovation. One satisfied client, Fykel, shared insights of their streamlined mobile payment solution, highlighting the professionalism and technical expertise that set our team apart. Our experts hold advanced certifications in cybersecurity, mobile app development, and financial technology, making them well-equipped to handle complex challenges while delivering robust, scalable solutions.

Client Testimonials and Success Stories

Real-life testimonials from our valued clients underscore the practical benefits of open banking integrations:

"Since integrating open banking into our mobile app, our transaction times have improved dramatically. We now process payments faster and with increased security, which has boosted customer trust and revenue." - Tech Startup CEO

"Our small business benefited immensely from secure mobile payment integration. It simplified our payment system, reduced costs and provided the flexibility needed to adapt to market changes." - Small Business Owner

"The integration process was transparent and efficient. The real-time processing and enhanced security protocols have set a new standard for our digital transactions." - Enterprise CTO

How Open Banking Integrations Can Be Tailored to Your Needs

Every business is unique, which is why our open banking integrations are highly customizable. Whether you operate in retail, finance, healthcare, or any other industry, our solutions can be adapted to meet your specific requirements. Customization options include:

- Tailored API Solutions: Create bespoke API endpoints that align closely with your business services, ensuring compatibility and seamless communication between platforms.

- Scalable Security Protocols: Adjust the security measures to reflect the size and transaction value of your business, whether you need ultra-high security for large enterprises or a more agile solution for startups.

- User Interface Customization: Design user-friendly mobile and web interfaces that reflect your brand identity while making secure mobile payments simple and intuitive.

- Integration with Existing Workflows: Our integration approach respects and enhances your existing operations, ensuring that new solutions are complementary to current systems.

- Industry-Specific Adaptations: Whether your focus is on ecommerce, fintech, or another niche, our team can implement specific enhancements to address industry challenges uniquely.

Frequently Asked Questions (FAQ)

Below are answers to some common questions regarding open banking integrations for secure mobile payments:

- What is open banking?

Open banking refers to the use of secure APIs to enable third-party developers to build applications and services around financial institutions. It focuses on data security, transparency, and innovative financial services.

- How does open banking improve mobile payment security?

By utilizing end-to-end encryption, multi-factor authentication, and real-time transaction processing, open banking significantly reduces the risks of fraud and unauthorized access.

- Can small businesses implement open banking integrations?

Absolutely. Open banking integrations are scalable and can be tailored for businesses of all sizes, making it an ideal solution for startups, small businesses, and large enterprises.

- What is the typical timeline for integrating open banking solutions?

The timeline can vary based on the scope and complexity of your project. However, with a streamlined process and expert planning, most integrations can be successfully deployed within a few months.

- Are open banking integrations compliant with regulatory standards?

Yes, open banking is designed with compliance in mind. It adheres to industry standards and regulations, ensuring that your business remains compliant with financial data protection laws.

Call-to-Action

If you're looking to enhance your mobile or web application with secure, efficient payment solutions, it's time to explore the benefits of open banking integrations. Invest in a future-proof payment infrastructure that ensures trust, speed, and reliability for your customers. Don’t wait—reach out today to learn more about how your business can thrive in the digital economy.

Contact us now at [email protected] or use the contact form in the footer to schedule a consultation. Take the first step towards enabling a secure and innovative payment solution that drives business growth.

Open banking integrations are more than just a technical solution; they are a strategic partner in your digital transformation journey. By embracing these advanced payment technologies, you position your business at the forefront of innovation, ready to meet the challenges of tomorrow with resilience and reliability. Start your journey toward secure mobile payments and see tangible results in efficiency, revenue, and customer satisfaction.

Embrace the power of secure, efficient, and innovative payment solutions with open banking integrations. Whether you're a startup eager to make your mark, a small business looking to streamline payment processes, or a large enterprise aiming to innovate, the potential for growth and operational excellence is limitless. Secure your transactions and empower your business with the technology that is transforming the future of digital payments.

In conclusion, the integration of open banking into your mobile and web platforms is a game-changing strategy for any business. With enhanced security, increased efficiency, and scalable advancements, this technology offers both immediate benefits and long-term growth opportunities. Embrace open banking to redefine your payment processes, optimize customer experience, and drive your business toward a secure digital future.

Get a free quote

Instant Translation Features in Games: Bridging Language Barriers with FYKEL

Instant Translation Features in Games: Bridging Language Barriers with FYKEL

Discover how instant translation features in games can enhance player engagement and accessibility. FYKEL specializes in developing innovative gaming solutions.

Secure E-Commerce Platforms for Retailers in New Mexico

Secure E-Commerce Platforms for Retailers in New Mexico

Empowering Retailers with Secure E-Commerce Platforms

In today's competitive digital landscape, New Mexico retailers need more than just a presence

Importance of Page Load Speed for SEO: Accelerate Your Business Growth with FYKEL

Importance of Page Load Speed for SEO: Accelerate Your Business Growth with FYKEL

Discover why page load speed is critical for SEO and business success. Learn how FYKEL's expert IT solutions in development, design, and digital marketing can propel your online presence.

App Customization for Niche Markets: Elevate Your Business with FYKEL

App Customization for Niche Markets: Elevate Your Business with FYKEL

Discover how customized applications can elevate your business in niche markets. Partner with FYKEL for tailored solutions that resonate with your audience.

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

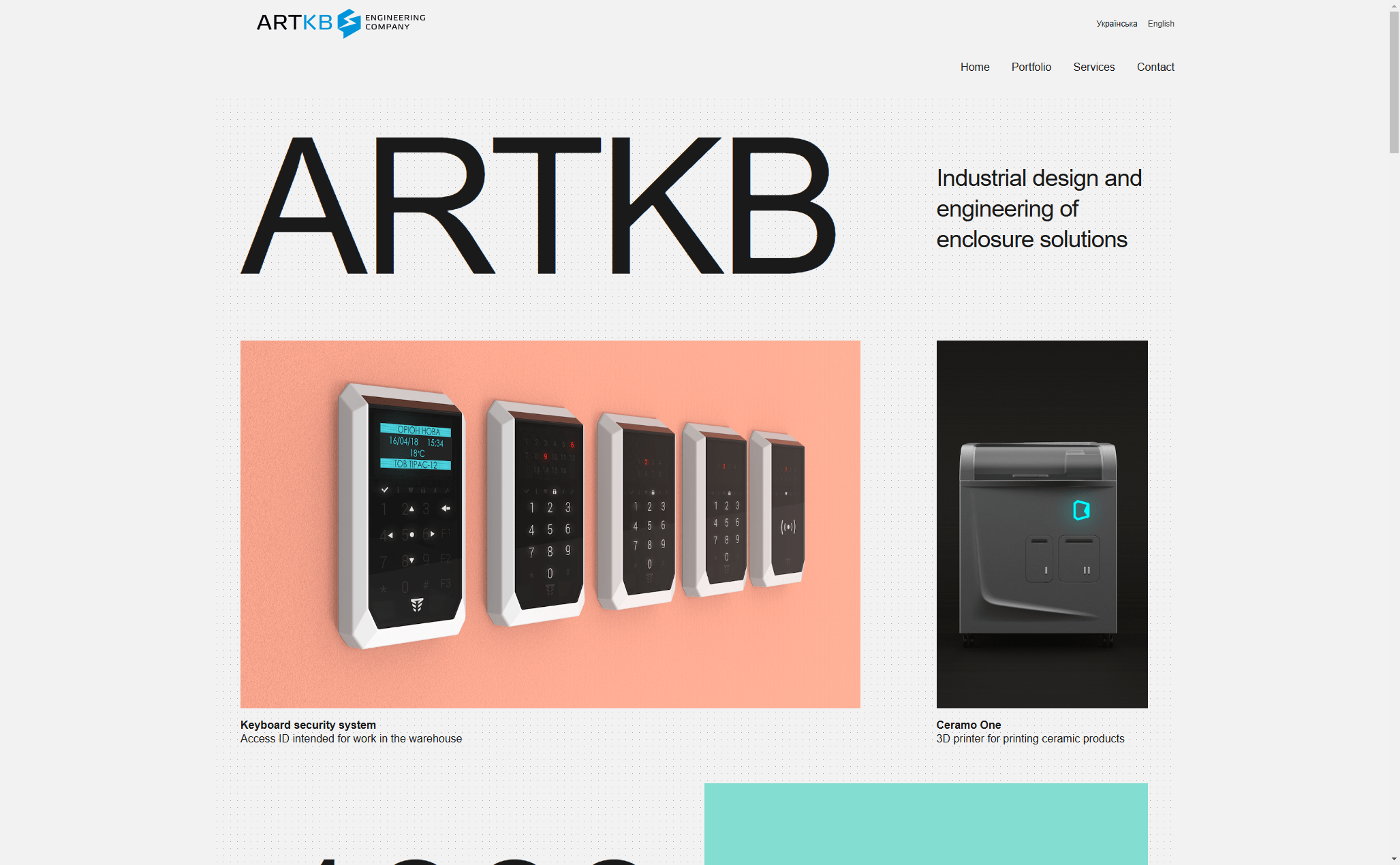

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

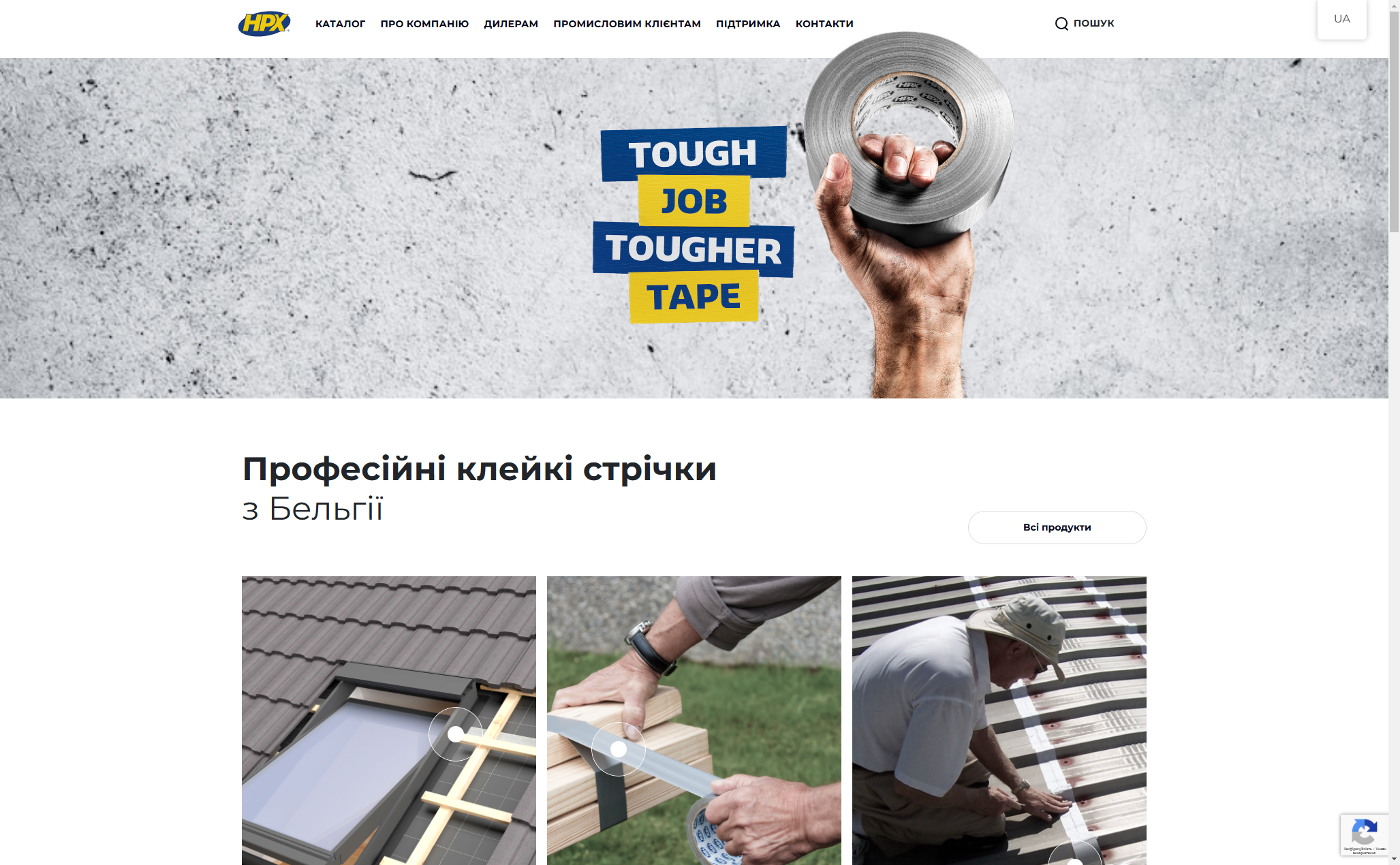

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce