- Seamless Mobile Payment Solutions

- Increased Security for Transactions

- Enhanced Customer Trust

- Real-time Transactions

- Improved Conversion Rates

- Access to Diverse Financial Services

Get a free quote

The Power of Link Building in Your SEO Strategy

The Power of Link Building in Your SEO Strategy

Unlocking SEO Success with Strategic Link Building

In today's digital landscape, the importance of a robust SEO strategy cannot be overstated,

The Future of WebAssembly in Enhancing Web Performance: FYKEL's Vision for Business Success

The Future of WebAssembly in Enhancing Web Performance: FYKEL's Vision for Business Success

Discover how WebAssembly is revolutionizing web performance and how FYKEL integrates innovative tech with expert development, design, and SEO to drive business success.

Improving Navigation for Faster User Journeys: A Key to Business Success

Improving Navigation for Faster User Journeys: A Key to Business Success

Understanding the Importance of Navigation in User Experience

In today’s fast-paced digital landscape, a website’s navigation is more than just a

Exploring Career Paths in Web Development with FYKEL: Opportunities for Growth and Innovation

Exploring Career Paths in Web Development with FYKEL: Opportunities for Growth and Innovation

Explore career paths in web development with FYKEL. Discover how our expertise in Laravel, React, and design, along with top-notch SEO, drives digital success in the USA.

HaEdut - a special mobile application for reading the Bible The HaEdut Bible app, built with Expo React Native, offers a seamless way to read the Scriptures in Modern Hebrew, Masoretic, English, and Russian. Perfect for students and newcomers, it features an intuitive interface and smooth performance for a modern Bible experience.

Aliend and Morph - wordpress game website It acts as a digital portal into the client's immersive branding philosophy, inspiring potential clients to think beyond conventional branding strategies.

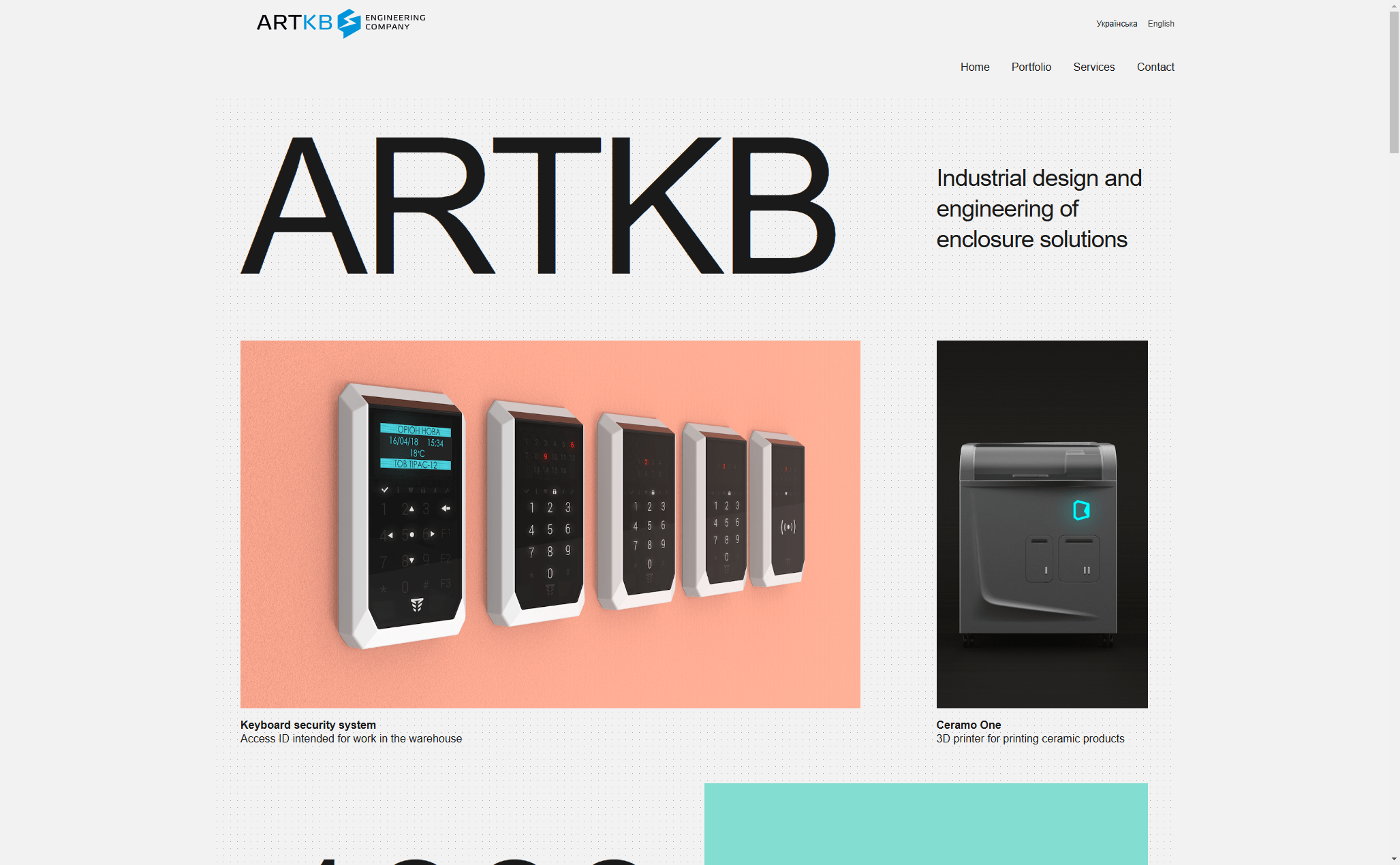

ARTKB - company wordpress website Custom Wordpress Platform for ARTKB to Showcase Their Hardware Engineering Excellence

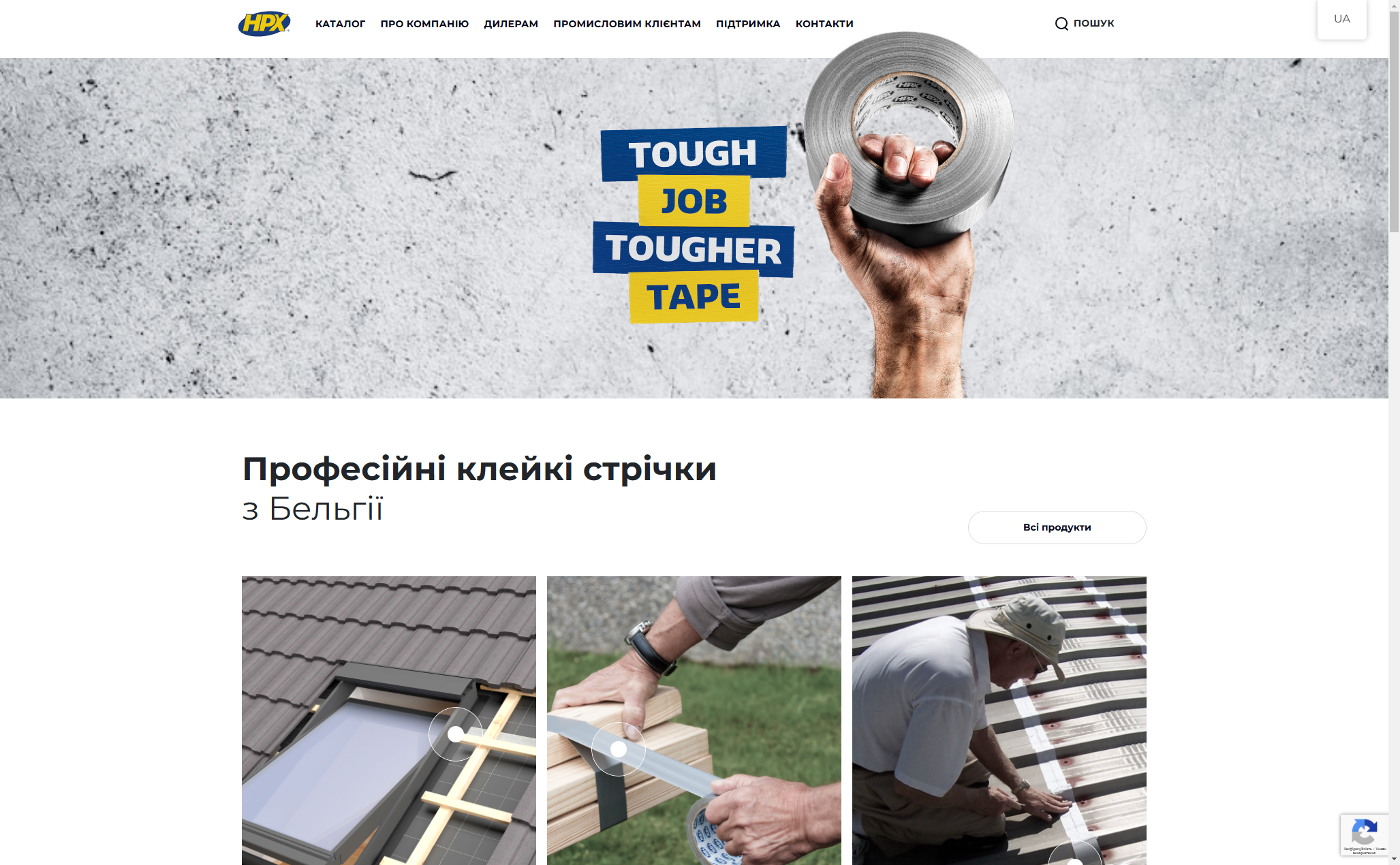

HPX - unique product store | wordpress E-commerce platform for HPX.ua using WordPress and WooCommerce